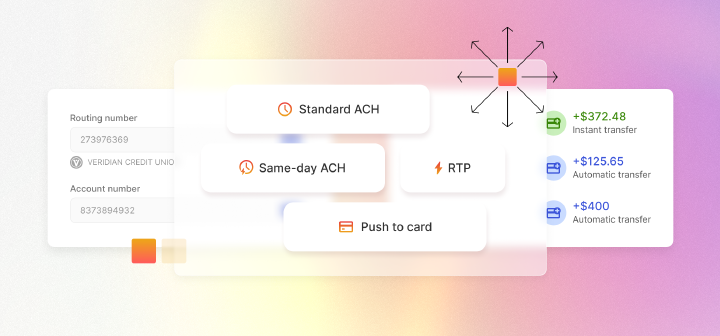

As we approach our fourth year, fintech_devcon continues to redefine the conference experience. Founded on the vision of creating a relaxed, educational environment free from sales pitches, our event focuses on what truly matters: the developers shaping the future of fintech.