Enabling choice & simplicity in debt repayment

Late payments are a real problem—for borrowers, lenders, service providers, and the entire economy. The World Bank estimates that they cost the global economy more than $40 billion a year. There are a lot of reasons for late or missed payments—from cash flow issues, inaccurate or confusing invoicing, or just forgetting a due date.

To that last point, when asked about the late payments they’ve made in the last six months, almost a quarter of respondents said they just completely forgot about a bill. More than 20% more said they mixed up the due dates.

In those cases it’s fair to say that, if the payers had been able to react quickly and move money at the last-minute, some of those late payments would’ve been on time, and the consequences—from fees to damaged credit or increases in interest rates—could be avoided. But because standard ACH has traditionally been the only option for loan repayment, there’s been no way to schedule and make payments last minute. ACH is just not built to handle “uh-oh-I-forgot-this-bill” speeds.

Debit cards, however, are.

In fact, as a payment method, debit cards occupy a pretty sweet spot. They offer the speed and convenience of a credit card, but without the associated fees and interest. In fact, a few years ago debit cards surpassed credit as consumers’ preferred plastic payment method.

Lenders and card companies are following suit. Lenders have begun to accept debit cards and some card brands are beginning to incentivize lenders for making debit card payments an option. But this can only be done (at least done simply) if their payment platforms, facilitators, gateways, etc., enable debit card repayment options.

This is where Moov comes in.

How Moov makes debt repayment quick and simple

Part of the solution to late payments is choice—allowing payers and payees to make and receive payments in a variety of ways—including faster, easier debit card payments. To that end, our platform provides direct connections to all the essential payment rails, including the major card brands, The Clearing House, and the Fed. And, of course, when it comes to loan and debt repayment, we enable both bank/ACH and debit card payments.

Debt repayment by debit card

As mentioned above, Visa, Mastercard, & Discover offer incentive programs that provide discounts and caps on the interchange rate for debit card transactions to lenders. These programs make accepting payments by card a much more attractive option, leveling the playing field in terms of cost between different payment rails.

Moov can enroll qualifying merchants, including financial institutions, into these incentive programs and, once enrolled, provide full transparency into interchange and card scheme fees.

For borrowers, it’s as easy as entering their card information into the repayment platform and then choosing to keep it on file for recurring payments.

For an even better user experience, borrower cards kept on file will also be enrolled in Moov’s card account updater, which automatically updates card information. For example, it applies new card information when the previous card expires. This saves the cardholder from having to manually update their payment information or, worse, missing a payment.

Debt repayment by bank account

Of course not everyone will want to use their debit card for debt repayment. Again, we’re all about choice, and there are some benefits to ACH. So Moov also makes it easy to enable traditional ACH payments—enabling the storage and verification of users’ bank account information.

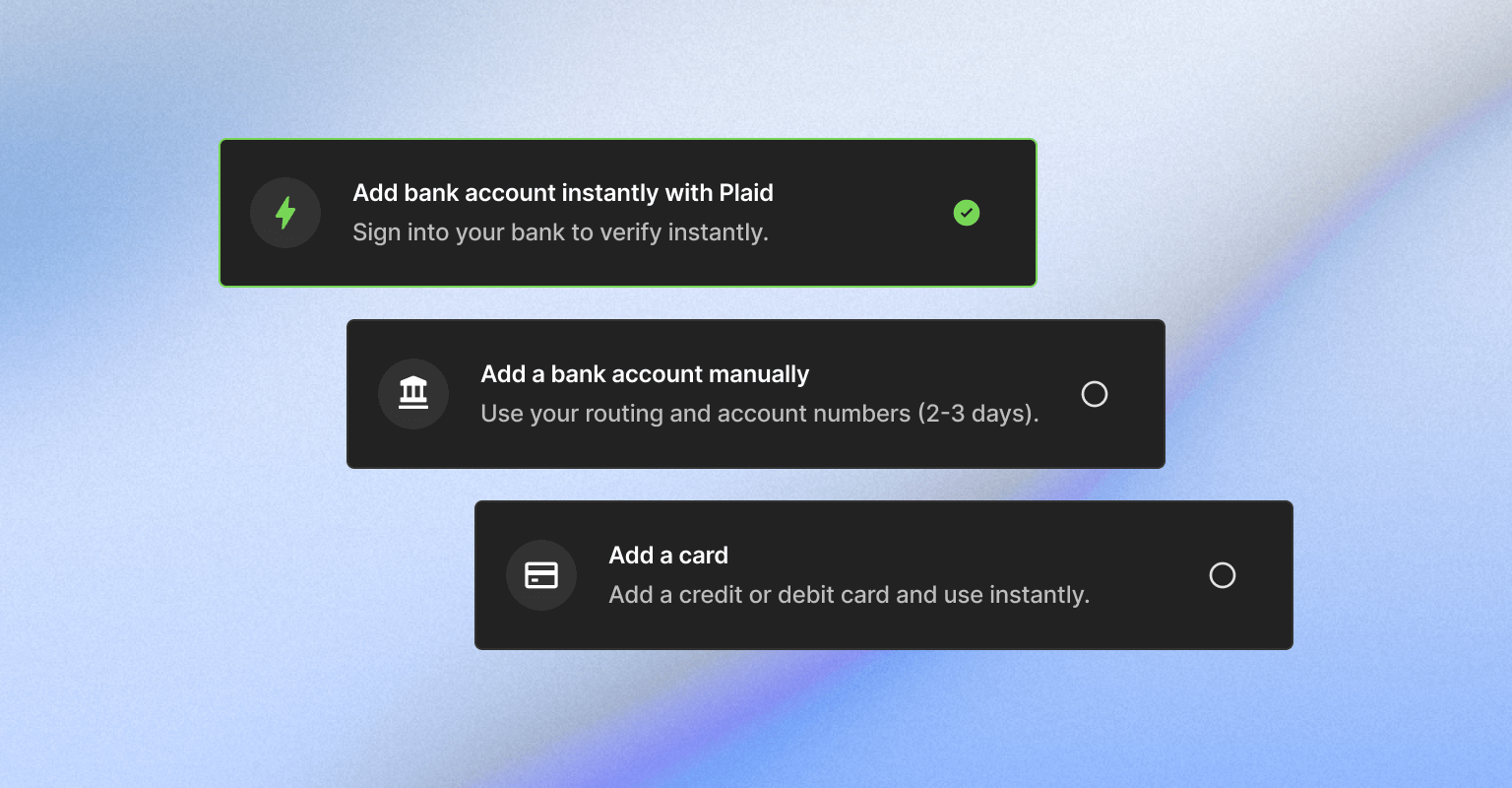

To set this up, there are a couple of ways users can link their bank accounts:

- Enter account & routing number and initiate ACH micro-deposits to be verified same-day or next-day.

- Leverage an open banking provider like Plaid or MX to instantly verify bank accounts from the user connecting to their online banking system.

Same as with debit cards, this info can be updated automatically as needed. If bank account details ever change for the account holder, such as a bank acquisition, the bank will send a notice of change (NOC). Moov automatically applies NOC updates to bank accounts as soon as they are received, helping avoid any problems with upcoming payments.

Simplicity, speed, and automation

Of course, enabling and updating the info for debit card and ACH payments is just the beginning of how Moov improves debt repayment experiences. We ensure compliance, transparency, ease-of-integration, and more.

Timing & transparency

ACH is a “no news is good news” rail. Unlike card networks or Real Time Payments (RTP), ACH doesn’t provide real-time state changes, so users have to assume everything’s working until they explicitly find out it’s not. To address this, Moov sends every ACH debit made before the last cut-off as same-day, reducing the time it takes to identify issues and speeding up the process compared to standard ACH timing.

To help our customers track the progress of money, Moov provides detailed timestamps for every state change—such as when an ACH payment transitions from originated to completed.

Staying compliant with Nacha

When creating a transfer, payment platforms indicate how ACH authorization was obtained by passing an SEC code. Typically, if the bank account information was collected on a paper form, the appropriate SEC code would be PPD. If the information was collected over the phone, the SEC code would be TEL. Alternatively, if authorization occurred through a browser, mobile app, or VOIP service, the appropriate SEC code would be WEB, which is the default in Moov.

Back-office process

Regardless of the payment method chosen by the borrower, all transfers are settled to the lender’s Moov wallet. Unlike traditional payment processors and providers, where each payment rail requires a separate reconciliation process and source of truth, the Moov wallet provides precise accounting details across all payment rails. This enables teams of any size to easily track payments, monitor ongoing progress, and ensure timely payouts to the lender, all in one centralized location.

Exception processing

Reporting categories are automatically applied to every transaction in the Moov wallet. For instance, if we receive an ACH return, a wallet transaction with the reporting type “ACH reversal” will be created and directly linked to the affected transfer. Likewise, if a debit card payment needs to be refunded in full or partially, those details are easy to understand and report on in Moov’s platform.

Automatic scaling

It’s typical for payments on loans and other debts to be made on the 1st or the 15th of the month. When you need to send millions of payments at a time, Moov has you covered with high availability. Moov systems are purpose-built for towering peaks & sustained demand on Google Cloud.

Moov can help

Convenience creates loyalty, making it important to provide faster and simpler payment options to your borrowers. You can help them avoid late payments, while also freeing your operations team to focus on what they do best.

To learn more, you can visit our debt repayment guide in our docs, or reach out to us with your use case.