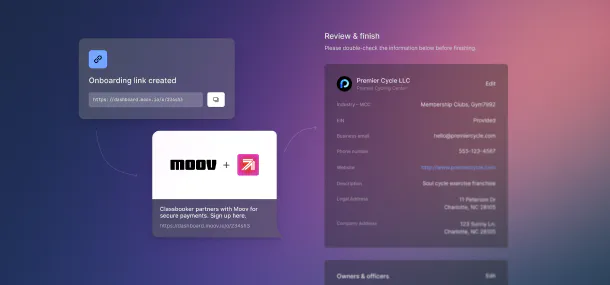

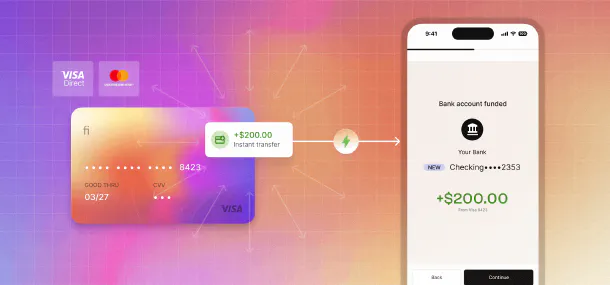

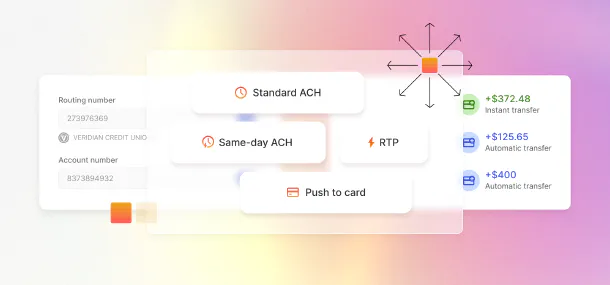

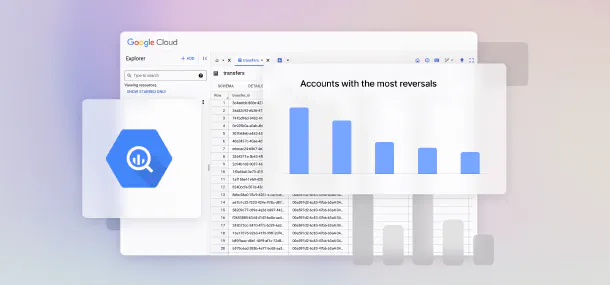

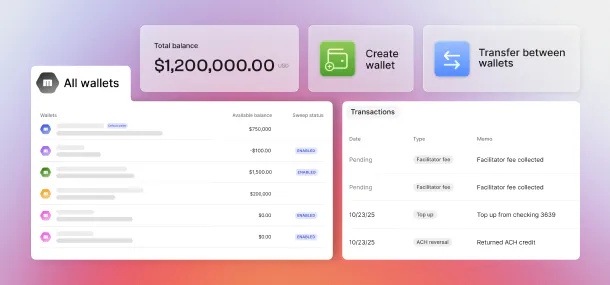

At Moov, we’re committed to helping businesses move money faster, smarter, and with greater flexibility. As our customers scale, we’ve seen firsthand how their fund flow requirements evolve—and how quickly manual workarounds can become bottlenecks. We’re excited to announce the launch of multiple wallets, a new way for platforms and businesses to organize, track, and manage funds with precision.