Intro to multi-rail disbursements

Payments are mission-critical for SaaS companies, and their customers expect multiple payment options. But offering more than one payment rail means orchestrating multiple systems from numerous vendors. This requires significant engineering resources—which many businesses can’t spare.

Moov resolves this dilemma by providing multiple payment rail options in a single solution. In this guide, we cover how transfers work with Moov and how multi-rail functionality could meet the needs of your business and users.

Multiple rails, one solution

| Payment rail | Timing |

|---|---|

| Standard ACH | Funds take a couple of days to reach the bank account. |

| Same-day ACH | Depending on when you send it, the funds could show up that same day. |

| RTP | Funds become immediately available, 24/7/365. |

| Push to card* | Available in a few minutes, 24/7/365. *Unlike the above options which use a bank account number and routing number, push to card involves collecting cardholder data. |

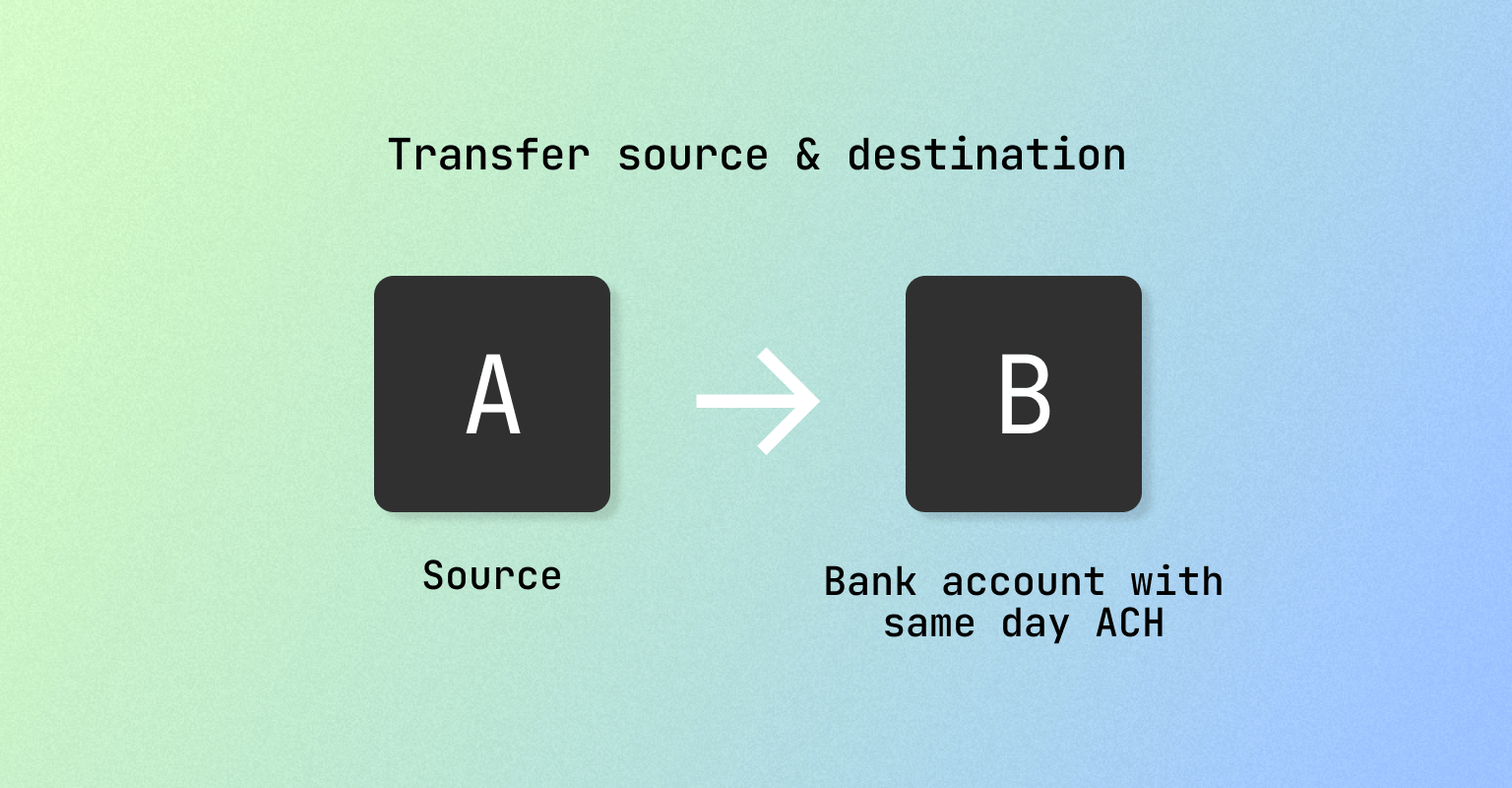

For a disbursement, your Moov account is typically the source “A” and you create a Moov account for every recipient “B” that you send funds to. This makes tracking transfers over time between every source and destination simpler than keying off of a tokenized payment method.

Adding sources: bank accounts and cards

Before making transfers with Moov, you link a bank account or link a card as the source from which you would move money to a destination.

Linking bank accounts

You can collect bank account information from your user yourself or through a Moov SDK.

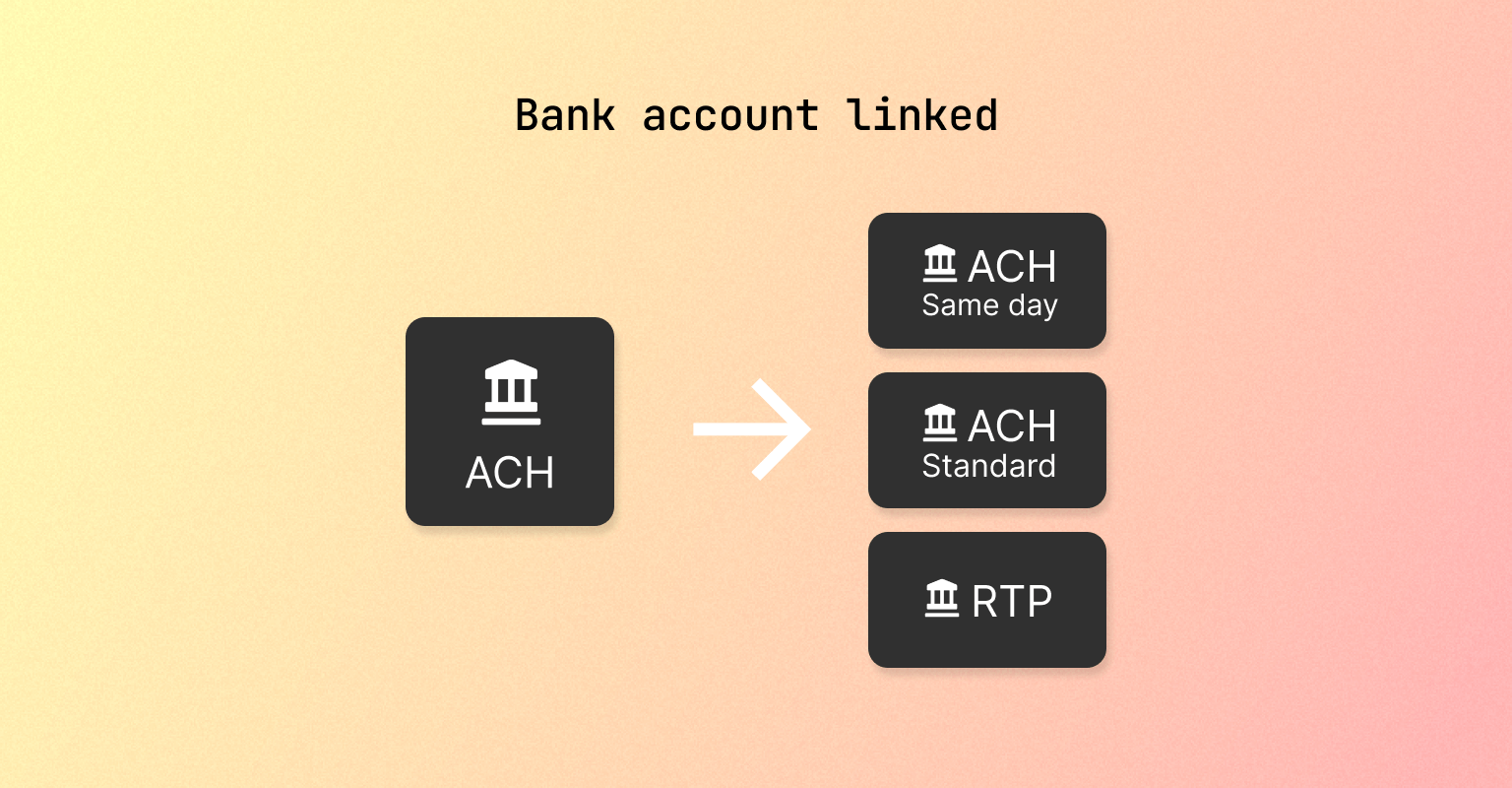

When a bank account is added to Moov, we automatically create payment-methods for every payment rail and speed that’s supported.

There’s no real-time check for whether an account is valid for ACH, but there is for RTP. We first look up the routing number to see if the financial institution is a member of the network. If it’s not, we won’t create the RTP payment method, so you’d pick one of the ACH options.

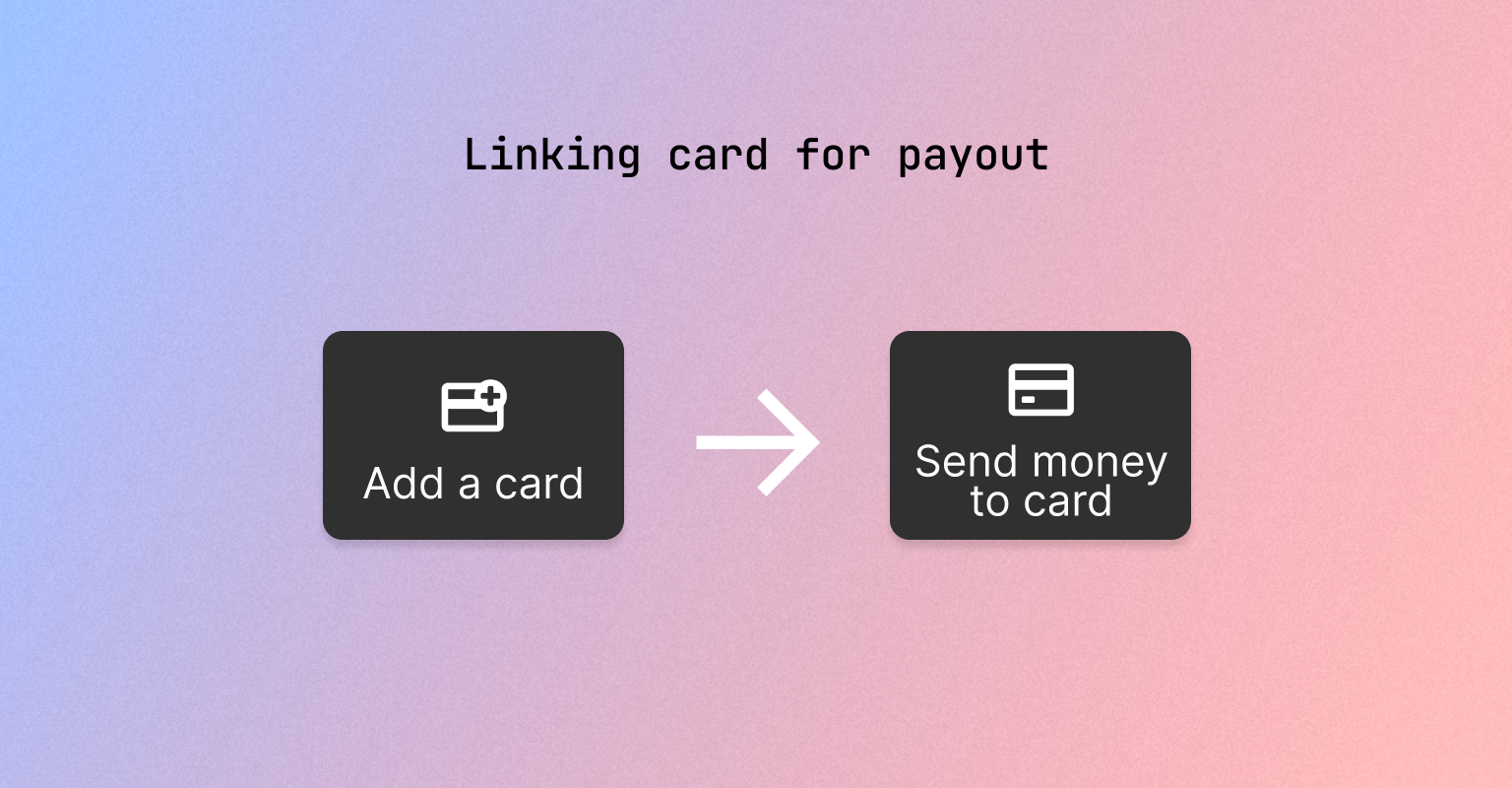

Linking cards

If you’re looking to offer a fast way to send a payout to someone and want to offer the ability to send to their card, Moov also allows you to link cards for payouts.

Pushing funds to a card, known as an Original Credit Transaction (OCT), involves gathering the cardholder’s data that Moov will secure and tokenize. Just like with linking a bank account, when a card is linked, Moov will tell you what options are available. Virtually all debit cards issued by a US bank are enabled to receive fast funds.

Moving money

You have multiple payment options in a single list that either your user can pick or you can pick for them (depending on if you’re optimizing for speed or cost), and then a single API endpoint for moving the money regardless of which is picked.

Reconciling

Moov wallets are an integral part of our approach to both money movement and reconciliation.

Our wallets allow you to send funds instantly and accept card payments; they also enable Moov to store funds on behalf of you and your users. But Moov wallets also provide much greater transparency than you’d receive from a bank ledger or aggregation system. Every flow of funds automatically creates a wallet transaction which is linked back to the source that generated it.

So, regardless of how money moves from A to B, all of the transactional data can be accessed via wallet transactions. You’ll always have the original context of every transaction, like how and when a payout was funded. Moov wallets also make it easy to categorize data by type, allowing you to view activity at the summary level for all rails in a single place.

All of this makes it easy to reconcile a balance regardless of how the money came in, especially when utilizing wallets as a single landing place for fund settlement before disbursing funds out to the final destination.

In practical terms, you can find any payment sent simply by listing wallet transactions; or, by using [meta data] and [foreign id], you can look up specific users or transactions.

Using transfer groups

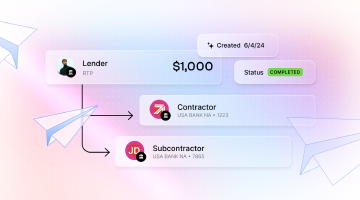

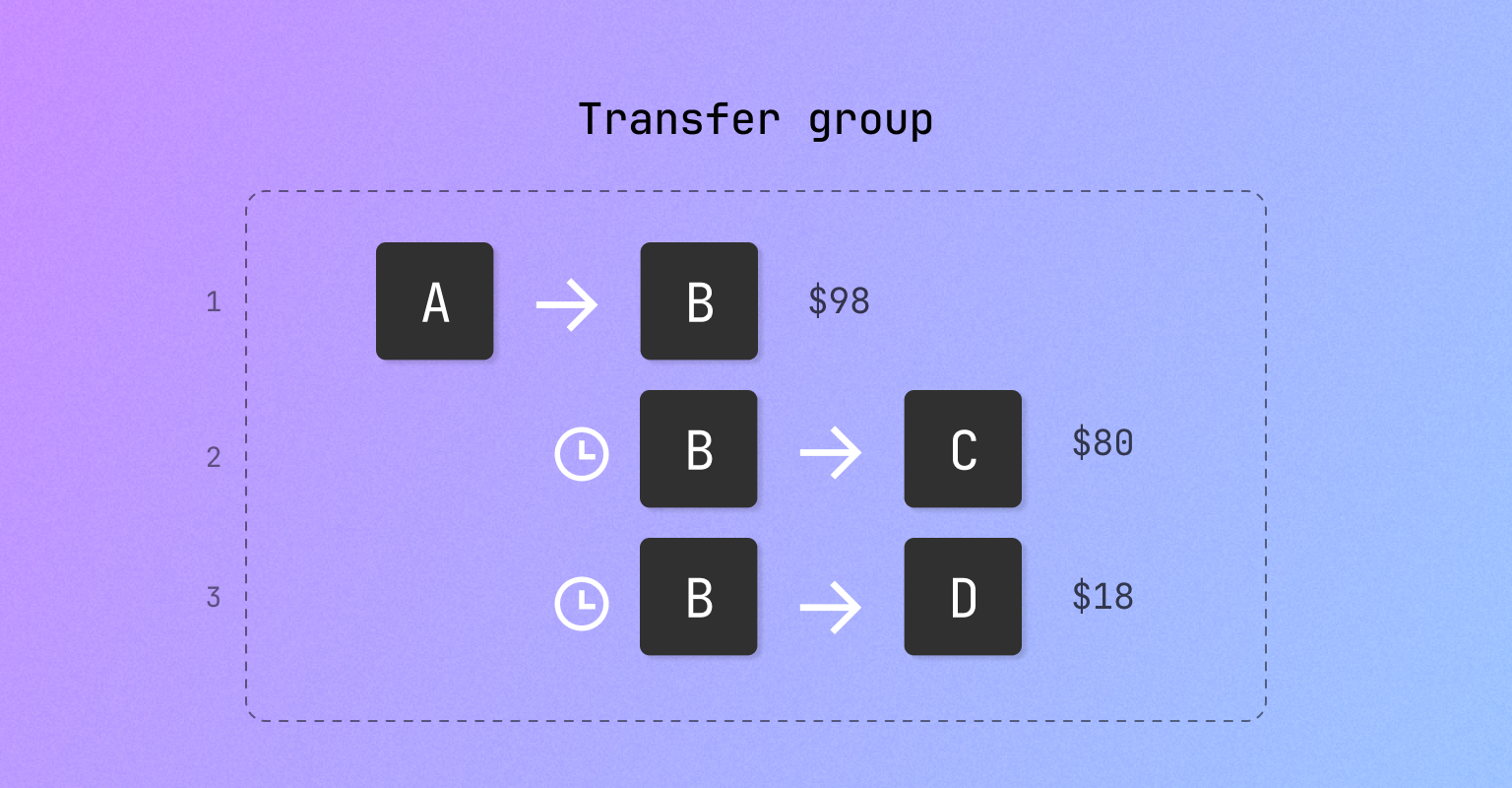

When multiple parties are involved in a payment flow that represents a single transaction, you can implement transfer groups to associate all of the transfers in the flow and run them sequentially.

When you create a grouped transfer, you can split a transfer into multiple child transfers with distinct destinations, as long as the sum of the child transfers is less than or equal to the amount of the preceding transfer. This gives you more control over the flow of funds and enables easier reporting, while preserving the context of the original transfer.

Using transfer groups with a Moov account enables visibility. You can look at a user’s Moov account and see all disbursements, regardless of rail, and easily calculate total disbursements.

Additionally, accounts could go through a KYC process, giving them cash custody as soon as it hits their wallet.

Setting up transfer workflows & automations

Sometimes moving money from A to B isn’t enough. We see use cases where a lender or contractor funds a single Moov wallet and intends for those funds to be disbursed to several different recipients as soon as the first transaction settles. Normally, this is a manual process, but Moov makes setting up these flows and tracking them for reporting simple.

Learning more

With Moov, product leaders no longer have to choose between a single integration with limited payment rails and multiple integrations in order to offer more payment rails. We’ve distilled transfers into the simple movement of money from a source to a destination, surfacing payment methods depending on the source you’ve added.

If you’re curious about how Moov can help your particular use case, chat with our payments experts.

To learn about more features, feel free to explore other relevant articles:

- Transfer groups: enable the most complicated money movement workflows and access helpful reporting and automation.

- RTP transfers: instantly send funds from a Moov wallet to a bank account with RTP.

- Push to card: provide faster access to funds for your customers by pushing funds to cards.