Just launched: Transfer groups

Moov’s mission is to make it easy for applications to accept, store, and disburse money. Transfers in Moov are instructions to move money between source A and destination B. But what do you do when you need to accept payment from one source and disburse it to multiple destinations? How do you collect a fee from one or more of those participants? How do you make sense of all of the individual money movements from a reporting and reconciliation standpoint? And how can you chain these actions together?

Introducing transfer groups.

Simple on the surface, transfer groups enable the most complicated money movement workflows and provide helpful reporting and automation.

Using transfer groups

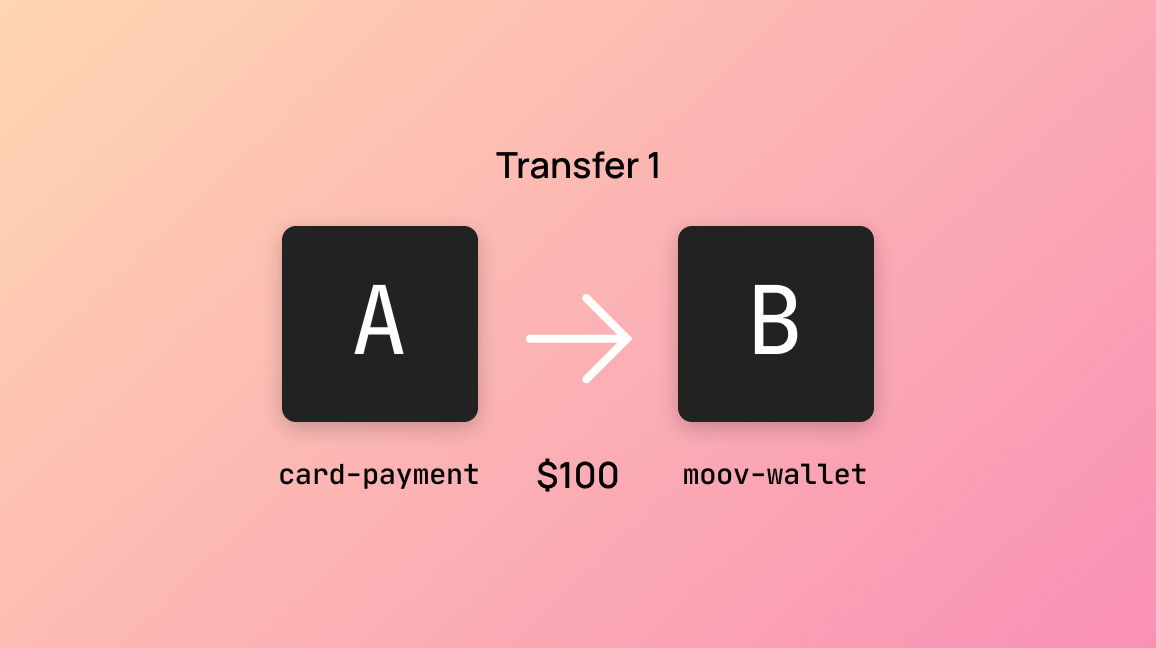

Consider a simple example: your platform is accepting a card payment from a user, and the net amount of that single payment will be routing to two different recipients. We’ll be creating a total of three transfers.

We’ll start by creating the first transfer for collecting the card payment from a user and settling those funds in your own Moov wallet.

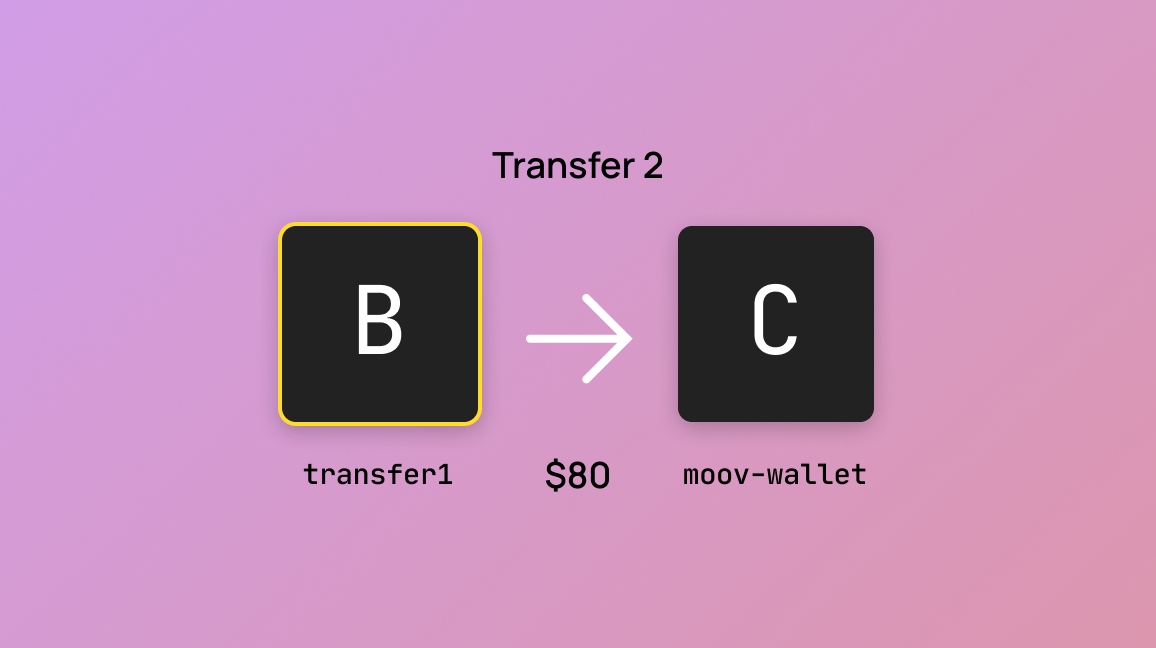

In this example, the card payment collected from the user will be available in your Moov wallet the next day. We want to add automation so that when those funds become available, the next step of our flow kicks off automatically.

To create the second transfer, we specify the transferID of the first as the source of this transfer and add an amount equal to or less than the net amount of the first transfer. Under the hood, Moov is checking out the destination of the first transfer and waiting for it to complete before it kicks off the second transfer. Until that point, the second transfer is in a “queued” status.

{

"source": {

"transferID": "transferID"

},

"destination": {

"paymentMethodID": "paymentMethodID"

},

"amount": {}

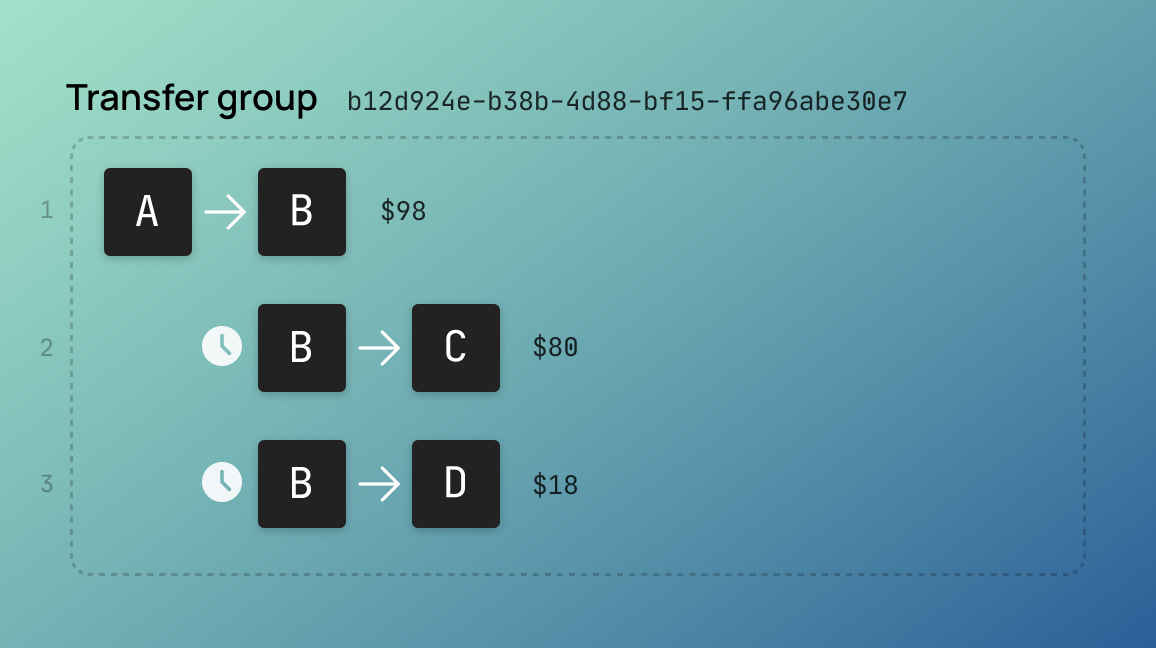

}For the third transfer, we’ll use the transferID of the first transfer again which results in two transfers queued to start when the first transfer completes.

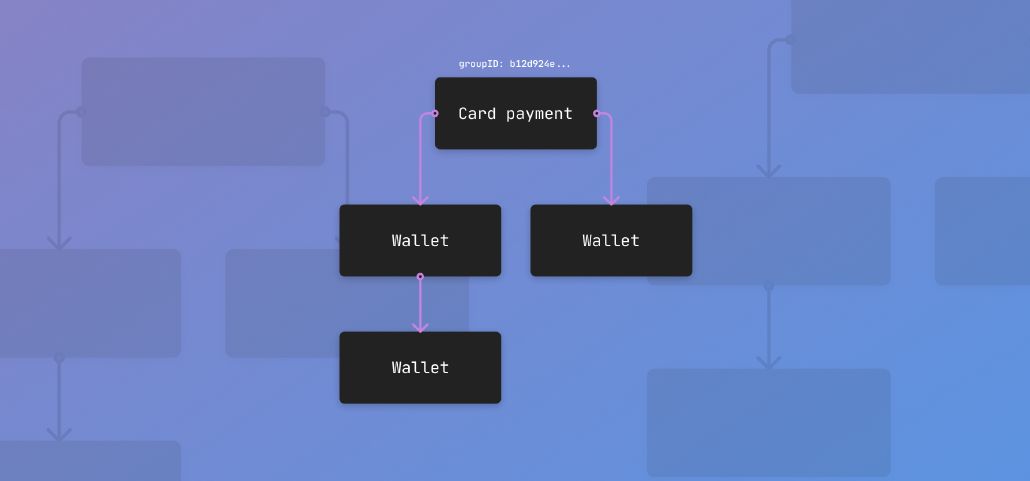

Whenever a previously created transfer is referenced as the source of a new transfer, a group is automatically created whose ID is added to every transfer.

Once the first transfer completes, the referenced subsequent transfers begin. Cashing out one of the transfers to a linked bank account prevents any additional transfers being created from that specific chain.

Using transfer groups not only allows you to automate complicated payments flows, but it makes reporting easy as well. You can quickly trace the source of funds and the ultimate destination regardless of how complicated a transfer group becomes.

Keep up with the latest

Want to know what else we’re up to? Review our changelog, join the community, or subscribe to our newsletter.