What the next generation of payments looks like

I’ve never been more excited about payments than I am today.

Admittedly, after twenty years in the fintech and payments industry, I’ve seen a lot of the same problems over and over. Payments veterans have wrestled with the same challenges and heard a lot of empty hype about the “next generation” of [insert thing here] that was going to solve everything but didn’t.

I should be jaded, right?

Over my career, I’ve yet to see any actual next generation of anything in payments. The plain truth is that most of the much-touted great leaps forward are pretty minor iterations of the same old thing. Just a fresh coat of paint, or a UI you can plug into a previous generation of technology. We’ve been stuck in an iterative state for at least 15 years.

This is why I joined Moov—because those iterative advances are great for what they are, but you can only do so much on top of our current infrastructure. It’s time for new infrastructure. Let me clarify with a hypothetical example of where we’re at in the payments space.

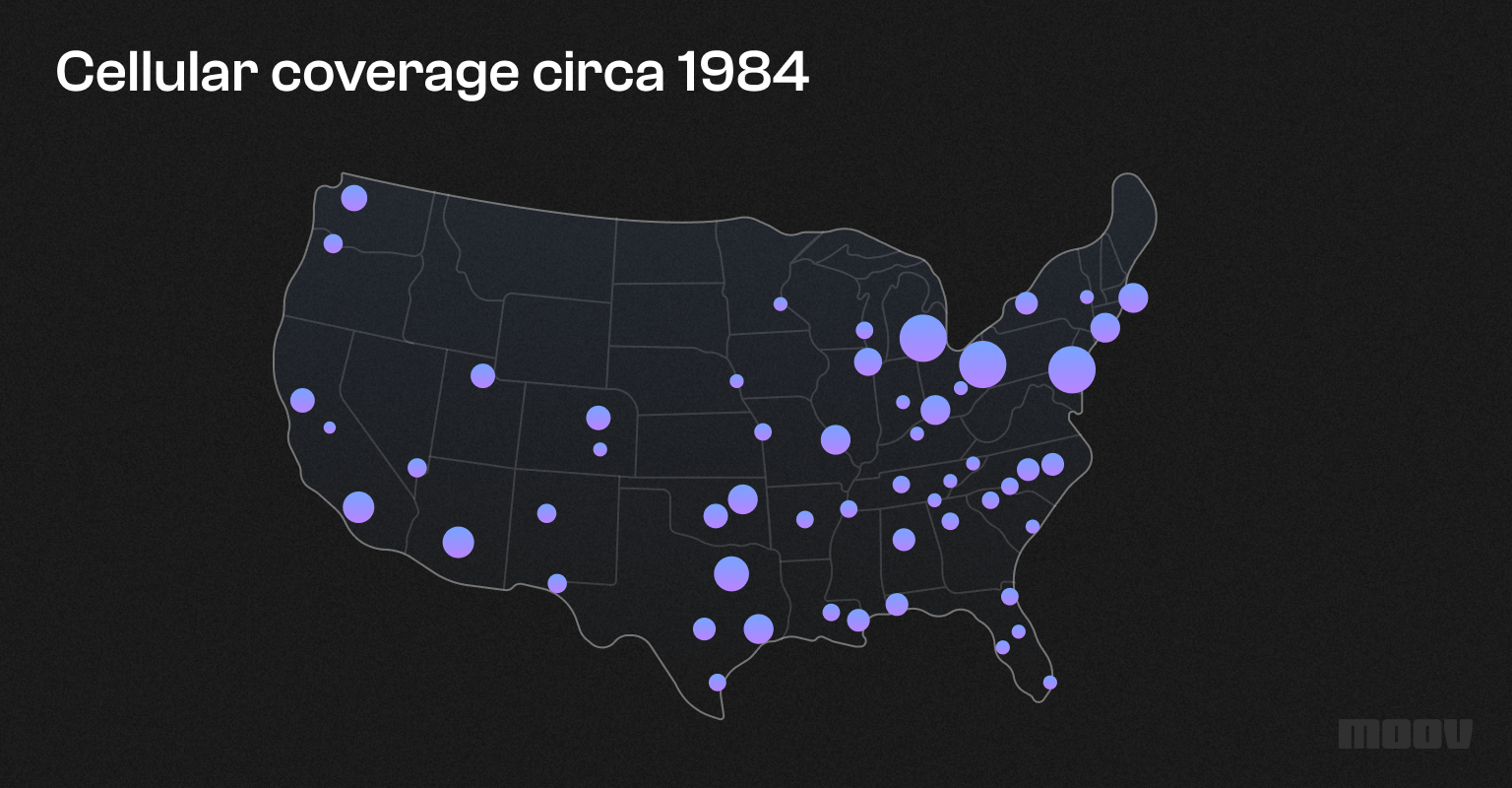

Imagine if the iPhone was invented in 1984, before wifi or even dial-up, and with cellular coverage that looked something like this:

Could this 1984 iPhone be a sleek piece of tech? Sure. Could it actually work worth a darn? Not with this sparse, 2.4Kbps, first-gen cellular infrastructure, no. Could you iterate on that iPhone and make improvements? Absolutely. But would it do anything close to what our 2024 smartphones can do? Again, no. The infrastructure would hold it back from becoming the lean, mean streaming machine that we’ve built whole new verticals and economies on top of.

Similarly, our current banking and payments infrastructure is holding fintech back from reaching untold potential—because the majority of that infrastructure was built in the 1980s. When we talk about embedded finance, we’re talking about sticking an interface on top of infrastructure built before the proliferation of the internet, online banking, smart phones, or payment apps. It is, as our CEO Wade Arnold likes to say, like putting lipstick on a pig.

Share thisAll this to say, it’s time there was a true next generation of payments and banking infrastructure.

For the jaded payments people out there, imagine the freedom and versatility it could bring about. Imagine what could be built on top of it. Imagine what we could do if the industry wasn’t tethered to 1984’s infrastructure.

And imagine the problems it could finally solve:

Reconciliation

Wade also likes to say, “Moving money is easy, reconciling it is not.”

Most payment platforms rely on multiple vendors to access different payment rails. Each one of them will have different settlement and reconciliation processes. Some are faster, some are slower. There are layers of dependencies and intermediaries that make things confused and inconsistent.

Just trying to understand what money is where at any given point is hard. All of this creates a lot of work and can lead to pretty massive errors.

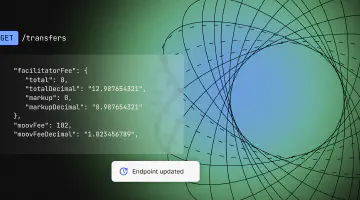

A true next-generation infrastructure would turn this into a real-time ledgering system that can track and reconcile money movement at the transactional level without worrying about dependencies and batches and layers upon layers of intermediaries.

Speed of funds

The issue of speed mirrors reconciliation in a lot of ways. The existing infrastructure is confusing, complicated, and it invites inconsistencies and errors.

From a basic consumer-user point of view, money movement seems to happen pretty quickly. You swipe and you’re done. In fact, the industry standard for authorization is under two seconds.

Unfortunately, it’s more complicated than that—especially for businesses handling larger volumes. That two-second authorization is just step one of a process that can take days.

Imagine running a business and transacting across multiple rails; well after your buyers’ have completed their piece of the process, you’ll have hundreds or thousands (or millions, if you’re a large retailer) of transactions at different points in the settlement and clearing cycle. Some are just sitting still, waiting to move as part of a batch. Some will encounter problems between authorization and clearing; some will be subject to refunds or credits.

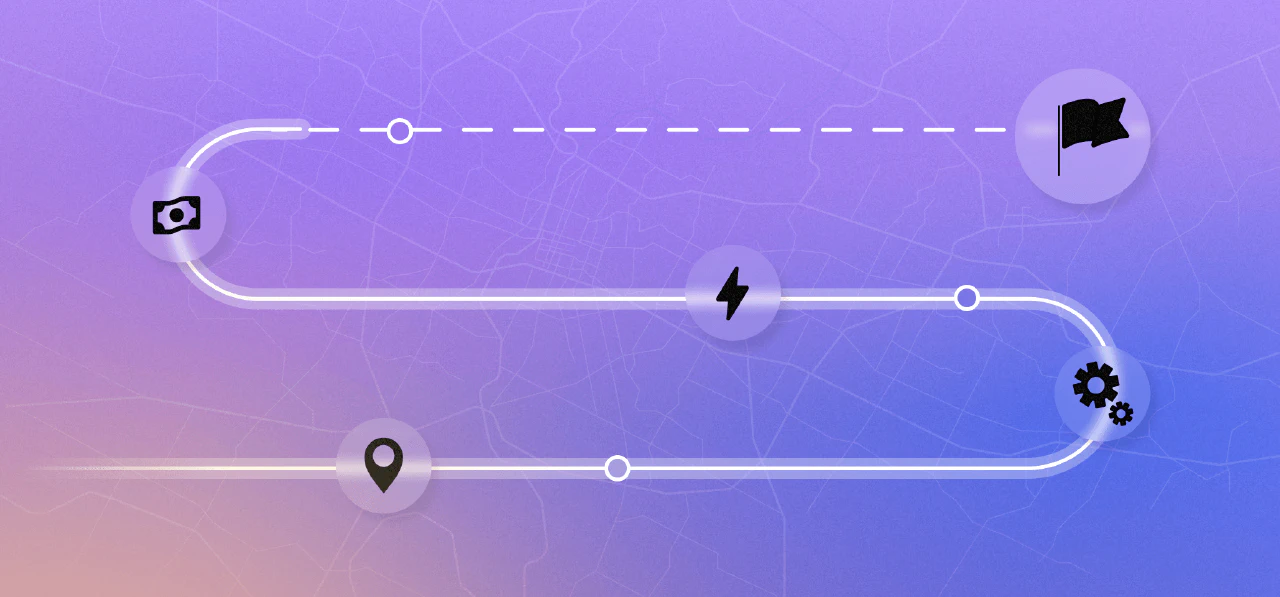

A truly next generation payments infrastructure would offer a single, real-time system of record. It would manage, track, and move funds seamlessly through a merchant acquiring transaction, into a digital wallet, then disburse funds out in myriad ways—traditional disbursements like ACH, or instant payments like Visa Direct or real time payments. One platform. One ledger. Multiple uses.

It shouldn’t be as hard as it is. After all, money is just data—and moving data shouldn’t take so long or be so difficult.

Monetization

Payments are expensive. When transacting through multiple platforms and rails, the merchant’s slice of pie gets thinner and thinner. The existing models are costly and can’t easily be monetized.

Here’s an example of what I mean. Let’s say you’re an internet service provider. You have a platform that manages donations for nonprofits. You accept payments from donors from multiple sources, across multiple rails, you pass those payments on to the nonprofit for them to do their good. You’re providing a service at a cost, you should be paid. But credit card companies and banks are taking a percentage of each transaction; some are also taking flat fees on top of the percentages. The old models give you very little control and make it hard for you to monetize your business—especially without taking too much away from the causes you support, which goes against the reasons you’re in business!

Share thisA modern payments infrastructure would be simpler, more cost-effective, and give you much more control over the movement of money through your platform.

Imagine being able to make money on every aspect of the transaction—as it comes in, moves out, and is spent. The current model limits; the next generation will expand opportunities for monetization.

So, why am I so excited?

A lot of what I’m saying might make the case for me being the jaded payments guy after all. This stuff is complicated. But I am excited. Because we’re finally on the cusp of this next generation. I’m thrilled that after 20+ years in the industry, I’ve joined Moov in building something new, different, and—finally—next generation.

Has it taken a lot of work? Yes.

Will it take more? Of course.

But I’m honored to be a part of this movement with an amazing team that’s working towards real, long-term changes to the infrastructure underlying payments. And I’m looking forward to seeing how this new generation of technology can help our customers move past the challenges above and create new use cases for money movement. We’re actually solving yesterday’s problems with tomorrow’s technology right now.

If you’re a payments nerd, or even a rookie and you want to chat about the payments space, I’d love to connect. To me, speed, reconciliation, and monetization of money movement are the big changes needed in the space, but I’d love to understand your perspective. Let’s geek out over payments tech. We’re always happy to connect with like-minded folks and share the excitement!