Modern tools for loan servicing platforms

Power your loan servicing platform with efficient payment management, automated compliance, and real-time insights to serve borrowers better.

Start in test mode →

Power your loan servicing platform with efficient payment management, automated compliance, and real-time insights to serve borrowers better.

Start in test mode →Manually managing payments, fees, and reconciliation creates operational bottlenecks and increases the risk of errors.

Outdated systems restrict borrowers’ payment options, leading to dissatisfaction and higher support costs.

A lack of real-time tracking and robust reporting tools makes it harder to manage cash flow and identify issues.

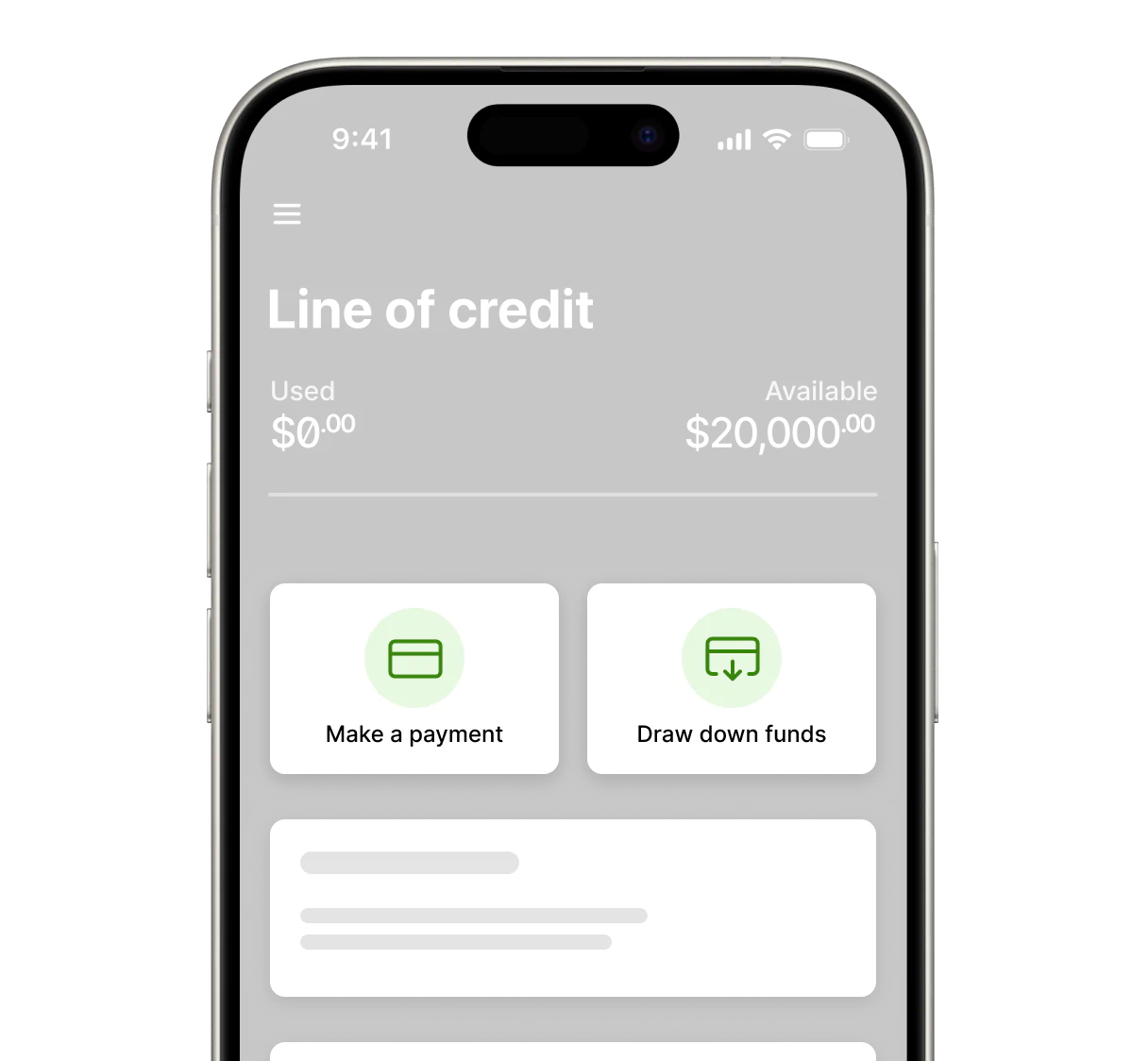

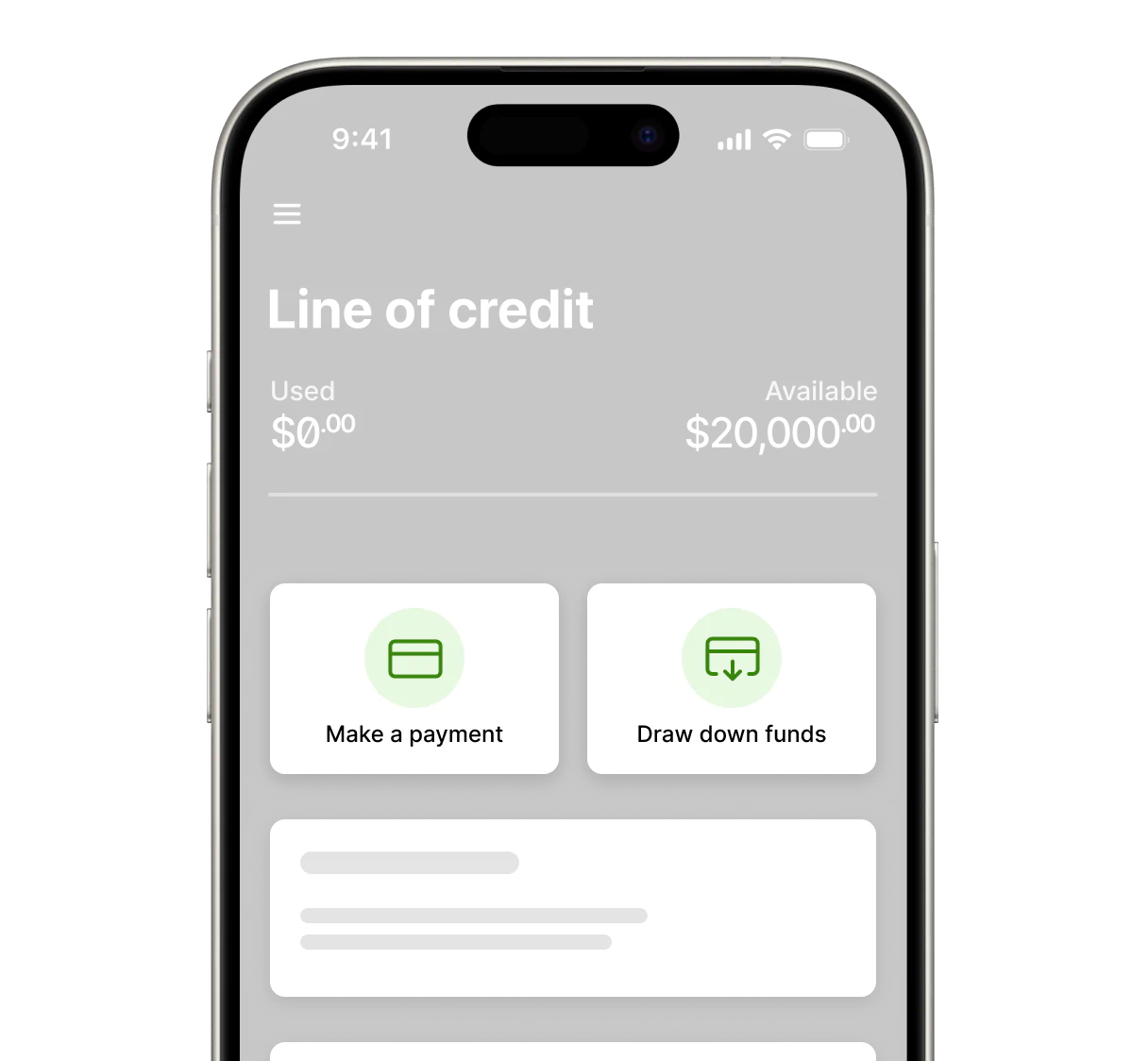

Loan originators fund a loan and then disburse to the borrower with ACH, RTP, or push-to card.

Reach any bank account instantly with Moov's direct connections to Visa Direct and Mastercard Send.

Send large disbursements instantly with RTP or fallback to tried and true ACH to reach any bank account.

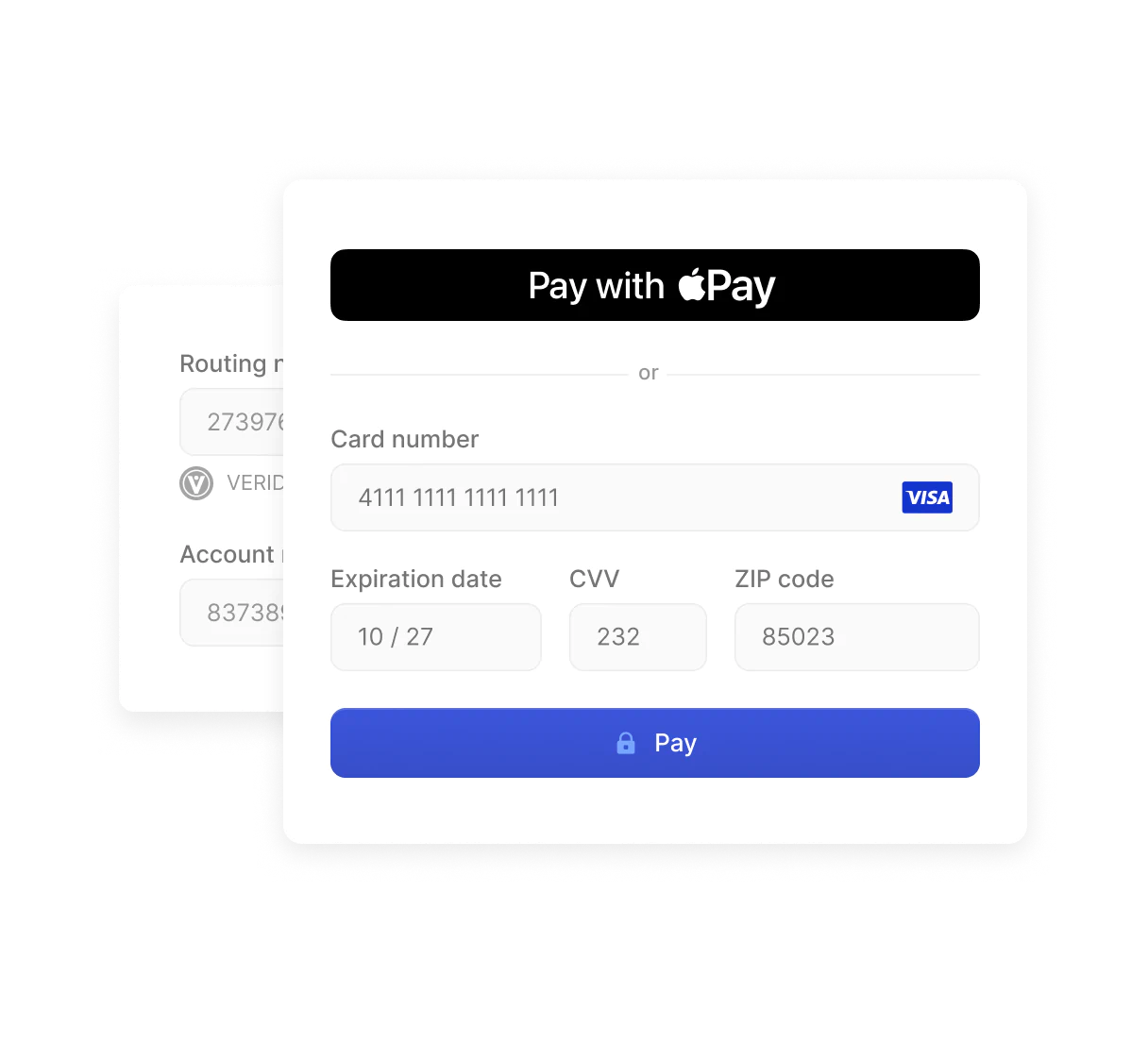

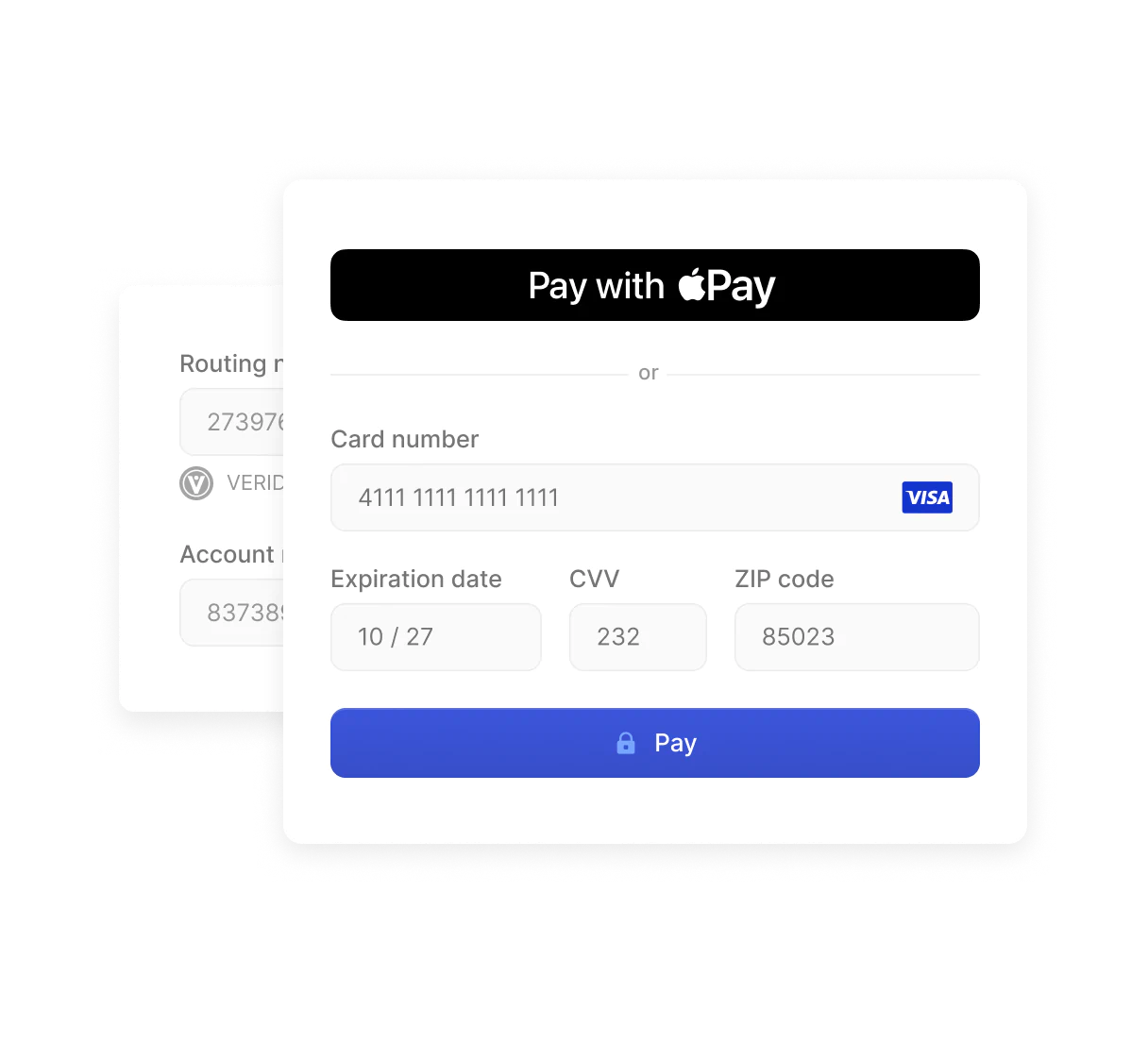

Offer more ways for borrowers to repay their loan with pay by bank, debit cards, and digital wallets.

Allow users to make a loan payment with a debit card with a capped interchange rate from the card brands.

Create a schedule to charge the user on each occurrence. Keep card details up to date with card account updater.

Financial institutions and fintechs breeze through onboarding with questions tuned specifically for their use case.

Capturing data is easy, but handling exceptions with a great UX takes time. Use our experience to get to market faster.

Ask for less and improve accuracy. Fetch business details from an email address and autocomplete addresses.