Your sales and company finances in one seamless experience.

Payments built for your business.

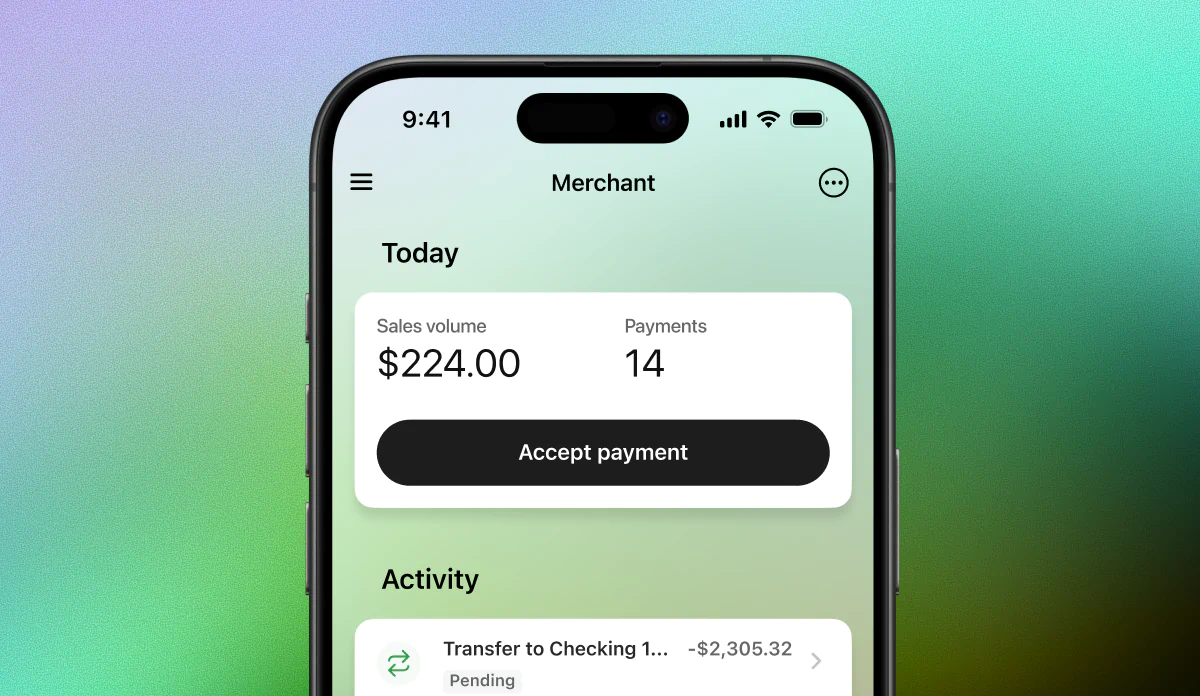

Combine your sales and your company finances into one seamless experience. From next-day settlement to transparent fees — access everything together.

Combine your sales and your company finances into one seamless experience. From next-day settlement to transparent fees — access everything together.

Bridge the gap between online and in-person payments. With Moov, your banking app is the point of sale.

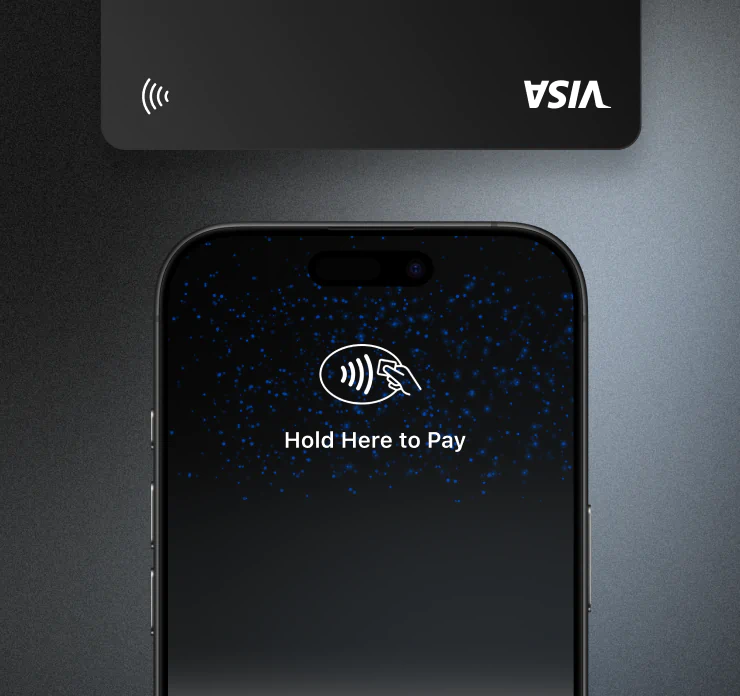

With Tap to Pay, you can accept all types of in-person, contactless payments right on your iPhone or Android device so you can reach more customers, take payments on the go, and explore new setups, like line busting.

From in-person transactions to online payments, get all the tools you need in your banking app.

Your sales and company finances in one seamless experience.

Accept contactless payments right on your iPhone or Android device.

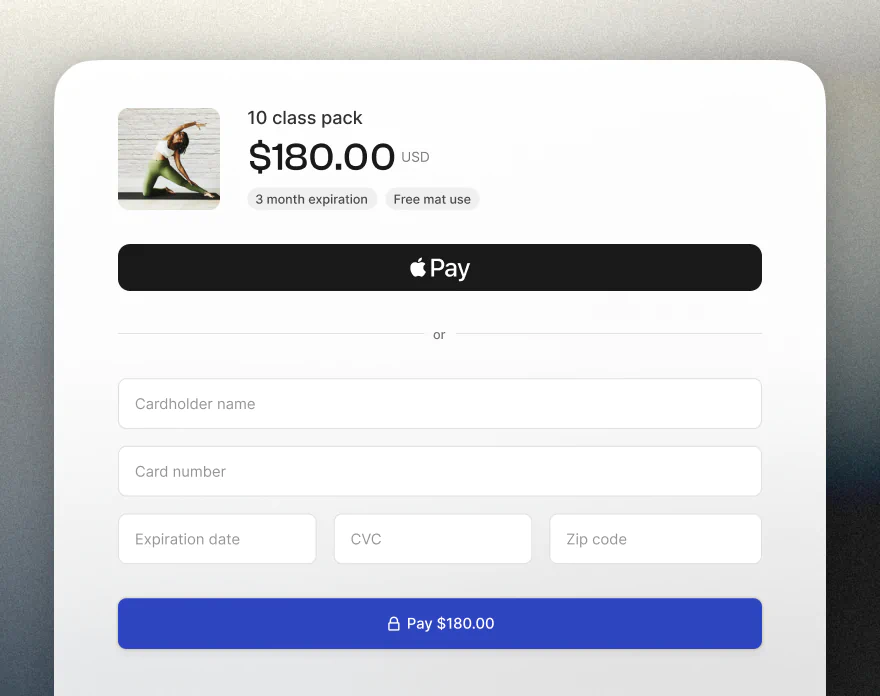

Share payment links via email, text, or QR code for easy online payments.

Funds settle directly to your bank account the next business day.

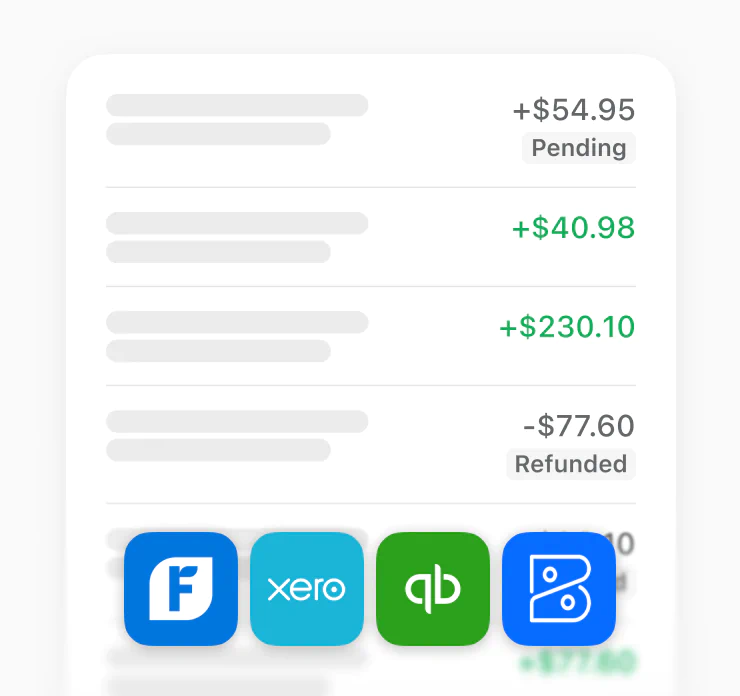

Payment transactions sync with the accounting software you already use.

Get help without leaving your banking app with built-in support.

Moov's pricing is simple and transparent. You pay 2.6% + 15¢ for every tap in-person and 2.9% + 30¢ for online payments.

No hidden fees. No commitments. No surprises.

Accept contactless payments using compatible iPhone or Android devices.

Per successful charge for U.S. domestic cards.

+1% for international cards.

Accept payments via credit/debit cards and digital wallets like Apple Pay.

Per successful charge for U.S. domestic cards.

+1% for international cards.

Automatically update saved card details when customers’ cards expire or are replaced.

Per update.

Manage chargebacks and payment disputes with built-in resolution tools.

Per dispute.

Open mobile or online banking and click on the Merchant menu option. If you don't see it, contact your bank to enable it.

Your bank or credit union will fill in the details they have on file to save you time. Pick the account you’ll use to accept payments.

Some industries are not supported. See our prohibited & restricted businesses.

After a quick review, you’re ready to accept payments. Your sales will settle directly to your bank account the next business day.