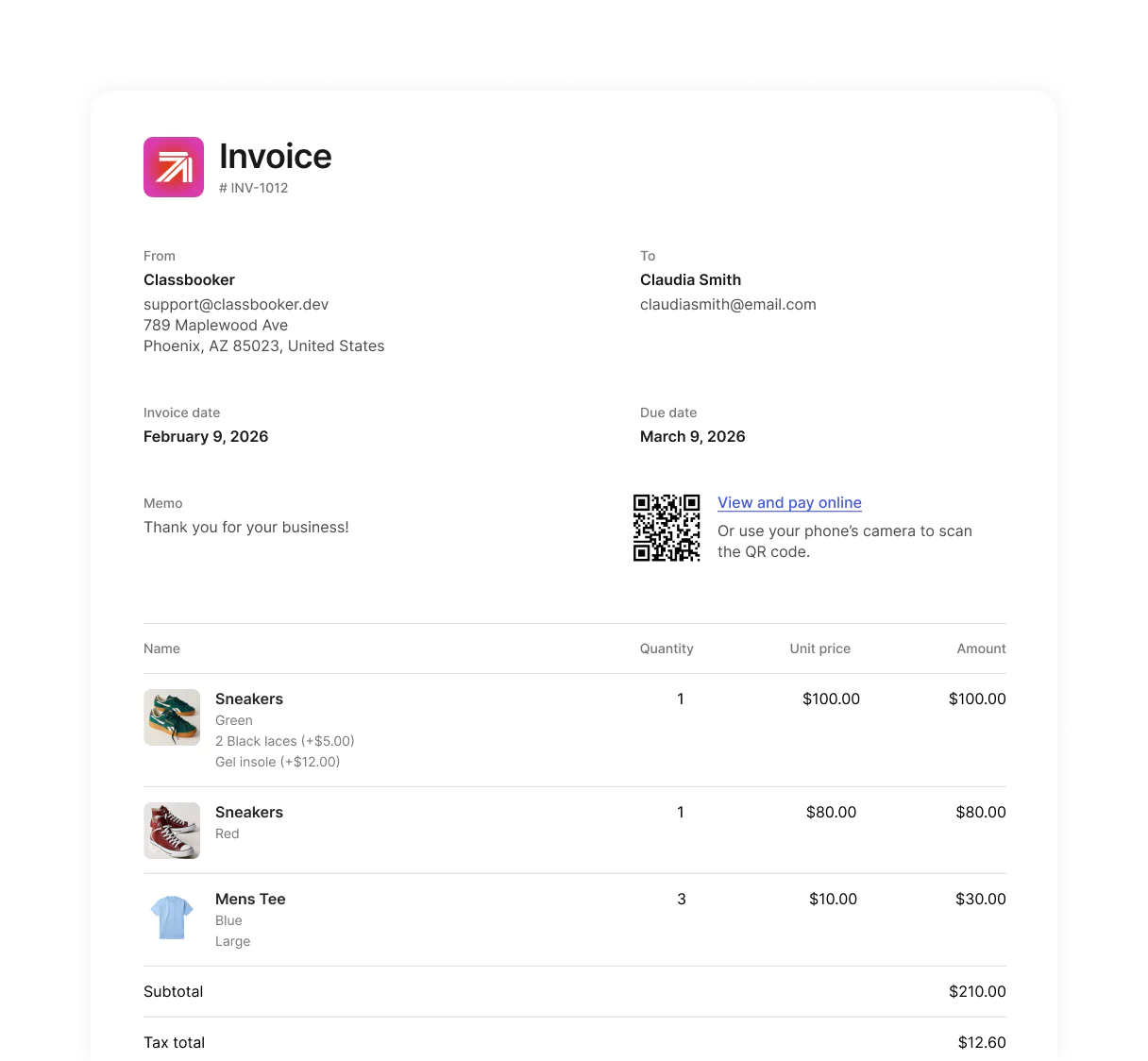

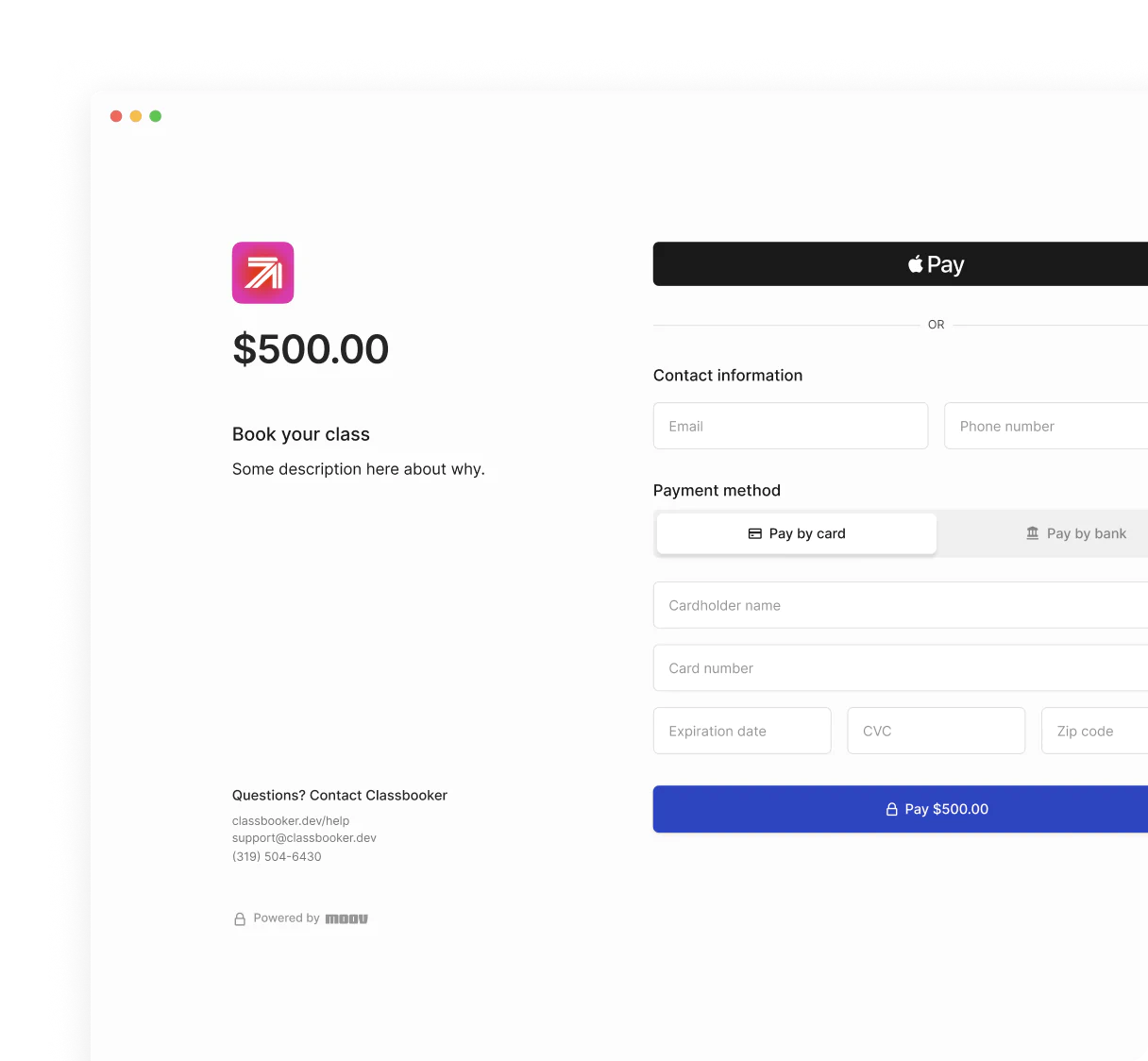

Enable more ways to get paid.

Add card acceptance with every major card brand and pay by bank to your app.

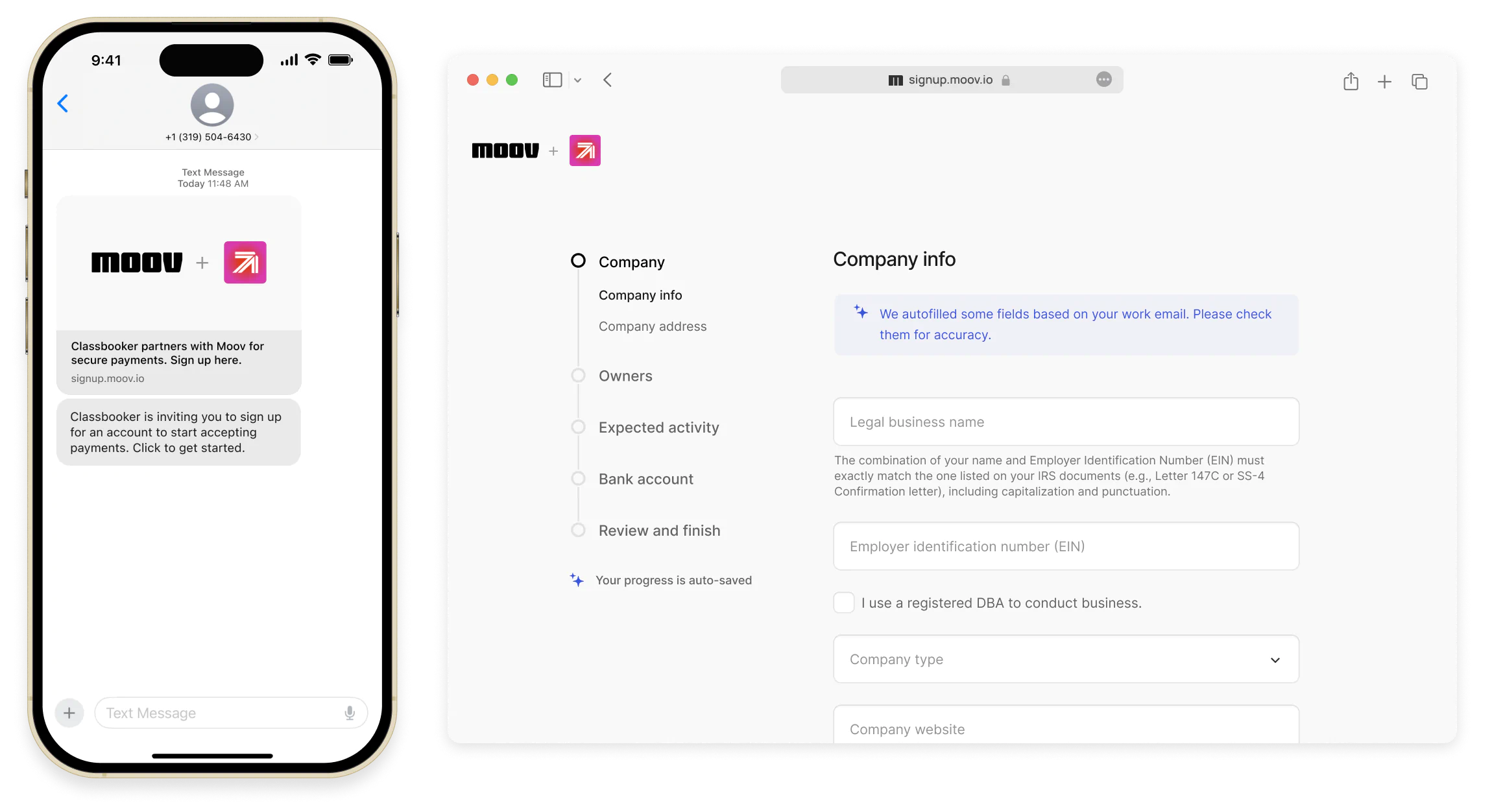

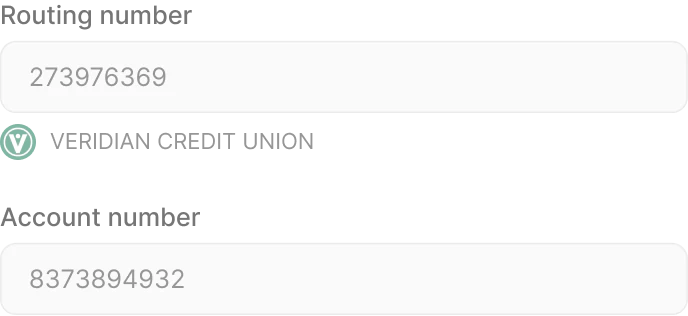

Onboard merchants in minutes

Moov handles everything from data collection to KYC/KYB and delivers a superior experience to your users.

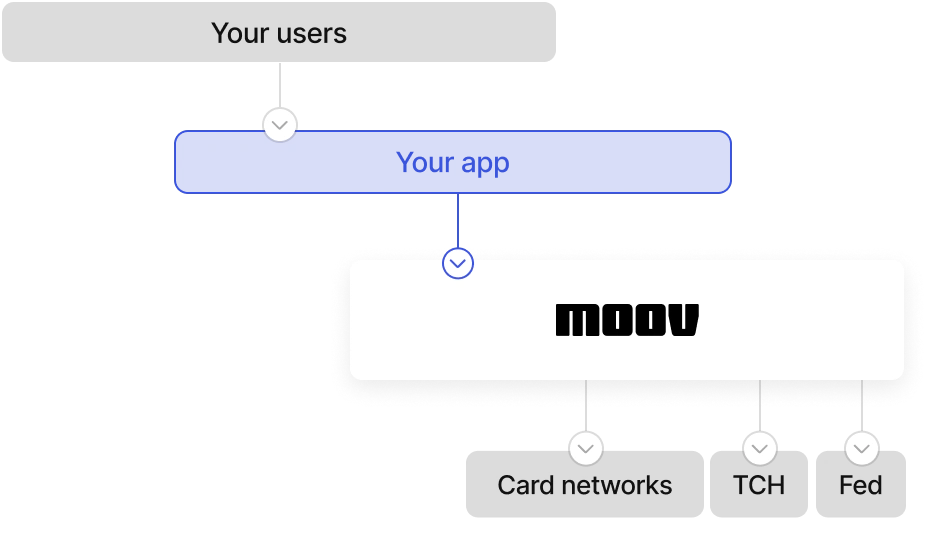

One endpoint, multiple rails

No added work on your part. Payments are created with the same integration, regardless of the payment rail.

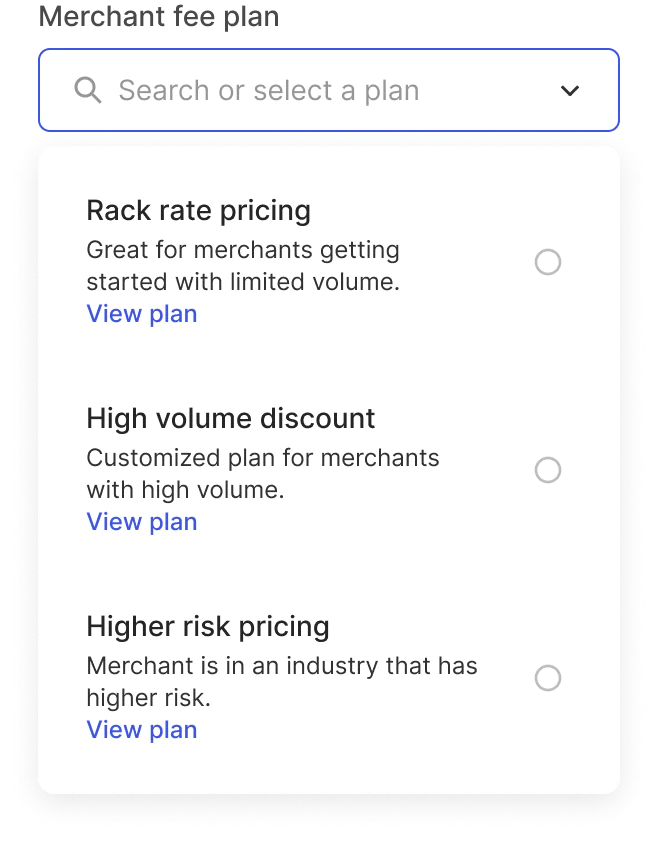

Grow revenue

Give your customers the freedom to accept card payments and customize how much revenue you earn as part of the transfer.

Scheduling made easy

Easily schedule recurring and future-dated payments, with Moov ensuring the payment information stays up to date.