Product release roundup: Feb ‘23

At Moov, we believe problem-solving should take priority over shiny new technology. While we love breaking the payments mold (in 2022, we became the only cloud-native acquiring payments Processor), we’re also laser-focused on getting the details right—down to the tiniest transactions.

To this end, one of our priorities is to provide transparency in the money movement process, specifically around money visibility. This makes reconciliation easier for our customers. Here’s an overview of our approach to providing transparency, as well as a roundup of some recent advancements to Moov’s platform.

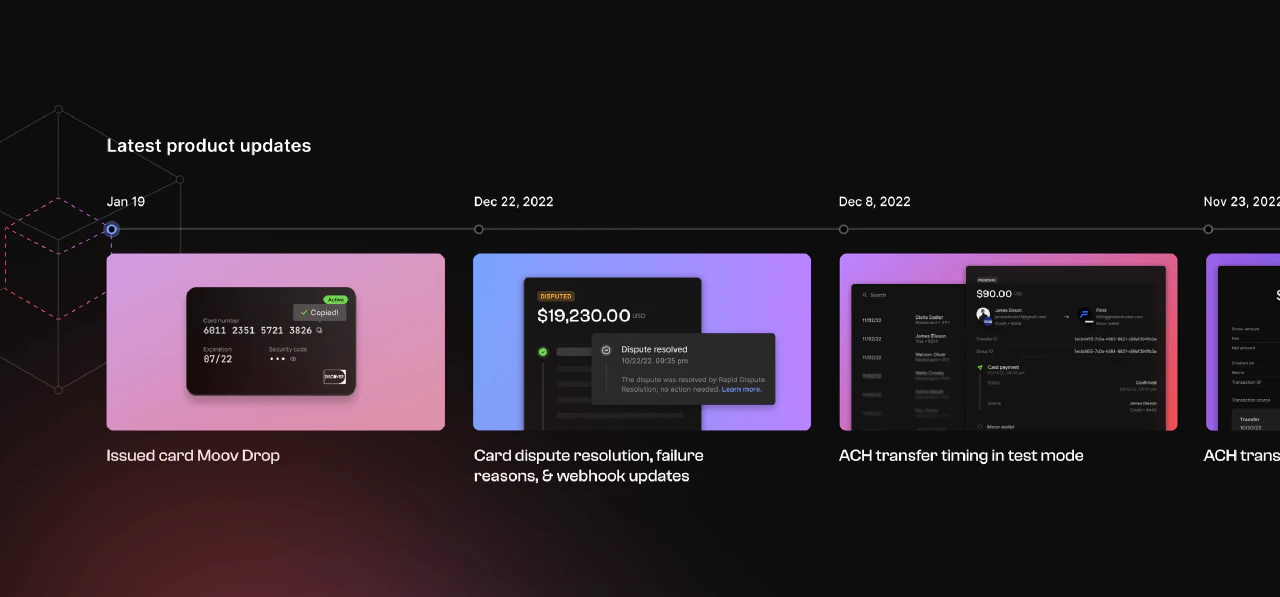

Wallet transactions

For context, wallets in the Moov platform allow account holders to store, accumulate, or cash out funds. Moov also processes refunds, fees, and ACH exceptions through wallets. Given the variety of use cases, we wanted to provide visibility into every instance of funds moving in or out of a wallet. To do this, we log a wallet transaction representing how the balance has been impacted. For example, if a Moov customer facilitates a merchant accepting a card payment and also charges a fee on that payment, you can see a record of the card payment, the fee collected, and the net effect of these transactions on the wallet’s balance. You can view wallet transactions in the Moov Dashboard or retrieve them via our API.

Without this level of granular tracking, users may see changes to their wallet’s balance, but may not know what caused the changes. This allows facilitators to monitor transaction-level activity and reconcile a wallet’s balance on any given day. Because Moov tags each transaction by type, facilitators can also create itemized reports to understand the breakdown of fees earned and paid, payouts trends, or whatever is relevant to their business.

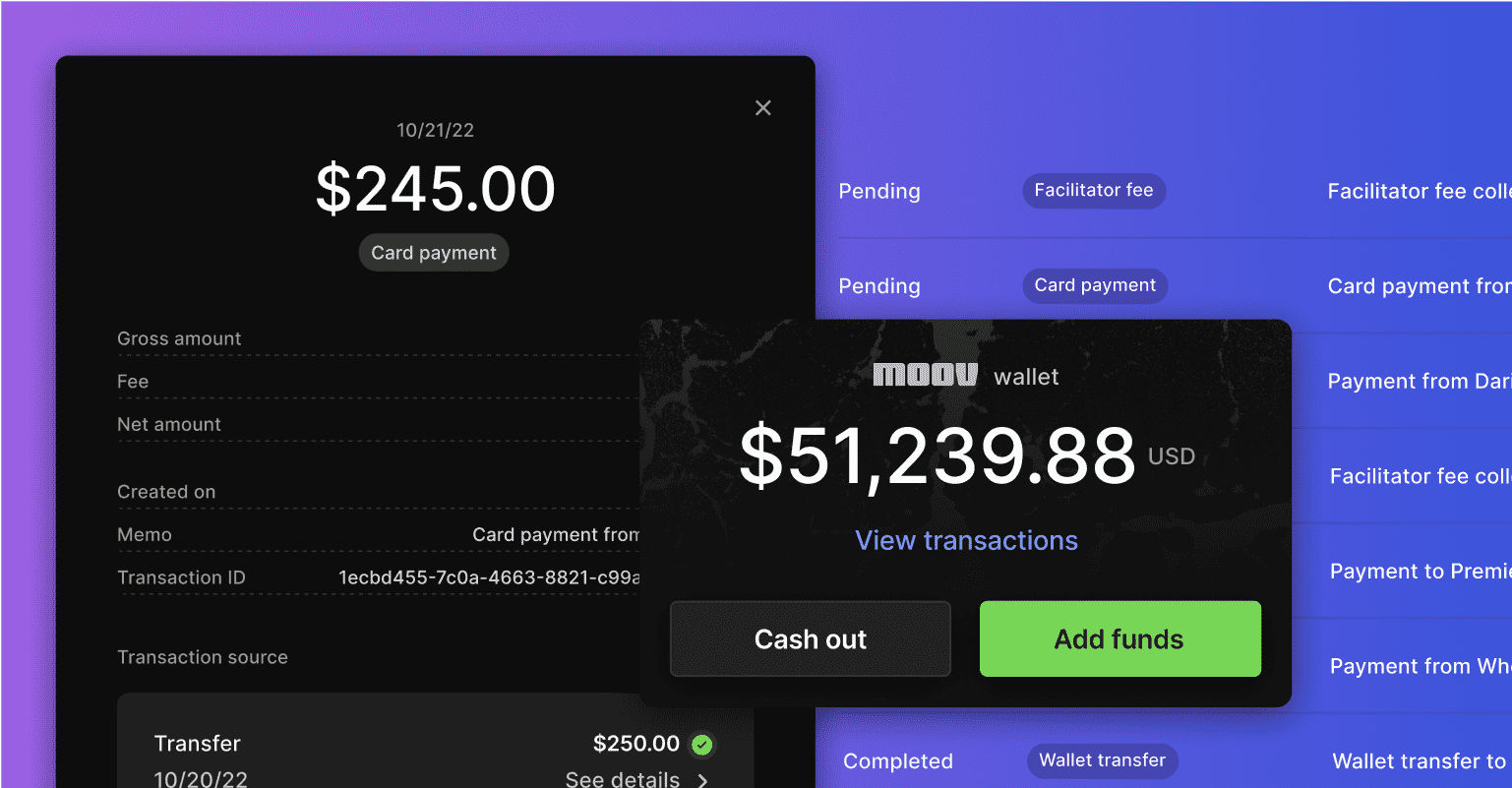

Visa Rapid Dispute Resolution

Disputes are an inevitable reality throughout the payments landscape and handling them has traditionally been a cumbersome, manual process, but now Moov supports Visa Rapid Dispute Resolution (RDR). This tool accepts disputes on the merchant’s behalf, based on the rules they set, empowering our customers to avoid unnecessary chargebacks. Pre-disputes resolved by RDR will automatically have the resolved status, saving Moov’s customers and their merchants the headache of another dispute.

Improved disputes visibility

Since Moov’s customers are responsible for ensuring their merchants are informed about disputes, we’ve improved the visibility of each dispute’s status and required next steps. Customers can monitor notifications on disputes by subscribing to the dispute.created webhook event, which will let them know whenever a dispute is created or completed.

The status field on each dispute will note whether it has been resolved or needs a response. For disputes flagged response-needed, we also include a respondBy field indicating how many calendar days the merchant has to provide their response.

And of course, at Moov, nothing is “done” until it’s been thoroughly documented. So, we’ve improved and clarified how to view dispute information and respond to chargebacks in our disputes guide.

More ways to ensure amazing experiences

Our pre-built UI components (aka Moov Drops) allow developers to create beautiful, compliant payment interfaces without having to do so from scratch. We recently shipped a new Issued Card Drop, which lets customers display a previously issued virtual card within a secure, Moov-hosted iframe. Note that our card issuing program is still in closed beta, but we look forward to opening it up for broader access in the future.

Separately, we’ve made lots of improvements to help our customers to know when and why something didn’t go as expected. We’ve improved our communication on failure reasons and card declines, so folks can understand why a transfer failed and what to do next. When a bank account validation attempt fails, we now surface a statusReason explaining why the validation attempt was unsuccessful.

Stay tuned

Remember, these are just a few highlights of our platform and some recent product updates. If you want to get all the good stuff (bug fixes, anyone?), feel free to view our entire changelog. We post updates there every two weeks.