Product release roundup: 2024

Now that 2024 is a wrap, it’s incredible to look back at all we’ve accomplished. Last year was about pushing boundaries, listening to our users, and delivering tools and features that make financial services more accessible and intuitive. From new payment capabilities to stunning new user interfaces, we’ve shipped features that empower businesses to move billions of dollars.

Here’s a roundup of the most exciting launches of 2024:

More ways to pay and get paid

RTP push

Real-time payments (RTP) are redefining the speed of transactions. Moov partnered with TCH to offer RTP Push, enabling businesses to send funds instantly, improving cash flow and reducing payment delays. We’ve already moved millions of dollars since launching support for RTP.

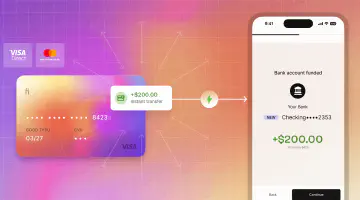

Visa Direct and Mastercard Send

With the ability to push and pull funds directly to and from cards, we made sending and receiving money faster and more convenient for businesses and their customers. These are powered by our direct integrations and partnerships with Visa Direct and Mastercard Send.

Visa commercial card issuing

A big leap in card issuing! Moov partnered with Visa to become a licensed card processor of Visa cards. Businesses can now mint virtual commercial cards for spend management use cases.

Instant bank account verification with RTP

Verifying bank accounts just got faster with real-time payments for instant bank account verification. Built on RTP, this feature sends $0.01 to the bank account instantly along with a 6-digit verification code to allow users to verify access to their account without waiting for ACH micro-deposits.

Payment links

Payment collection made easy! Businesses can generate payment links to accept payments or send payouts. Links can be shared via any channel, and Moov generates a QR code for each.

Smarter transfer tools

Recurring and future-dated transfers

We added support for recurring and future-dated transfers, allowing users to automate payments and plan ahead with ease.

Dispute management API

Handling disputes is now simpler with our new API, which streamlines the process and enhances transparency.

ACH TEL and PPD support

Expanding ACH capabilities, we added TEL (telephone-initiated) and PPD (prearranged payment and deposit) support to help businesses manage a broader range of payment scenarios. We moved billions of dollars in ACH each month of 2024.

Automated wallet sweeps

Businesses can now automate wallet payouts, ensuring funds are efficiently managed and securely transferred to designated accounts.

Loan and general ledger linked bank account support

Seamless bank account linking for loans and general ledger types simplifies financial reconciliation and enhances tracking.

Delighters

Account filter by capability and capability status

New filtering options in the dashboard and API help users quickly find and manage accounts based on specific capabilities and statuses.

Financial institution onboarding flow

A guided onboarding flow for financial institutions ensures a smoother and faster integration experience.

Improved transfer UI in the Dashboard

We revamped the transfer UI in our dashboard, making it even easier for users to create transfers manually with all the bells and whistles.

Hosted onboarding

Simplifying customer acquisition, we introduced hosted onboarding pages, giving businesses a no-code way to onboard their users.

Pricing plans

Introducing customizable pricing plans, empowering businesses to offer tailored solutions to their customers.

Brand colors for Moov accounts

Businesses can now customize their Moov accounts with brand colors, delivering a more cohesive and branded user experience.

Security, stability, and data

Data Sync

We announced Data Sync at Google Cloud Next ‘24. Moov data is synced to our customers’ data warehouses in near real-time.

End-to-end encryption for card linking

Security is a top priority, and with end-to-end encryption, we’ve added another layer of protection for card linking, allowing values to be encrypted on device and not decrypted until they reach the Moov service layer.

Performance tuning

We deployed countless improvements across the year to keep services not only up and running, but lightning fast as well.

AI

Ask Moov

We launched conversational search and page summarization in our documentation, allowing users to ask questions and get answers in real time. We have way more in the works that will make it even faster to get answers.

Augmentated back office

Every discipline at Moov has adopted AI to improve efficiency and gain a copilot. We built internal tooling that uses computer vision to validate driver’s licenses and passports better than a human can, as well as to summarize common document types and pull out the details that a person usually looks for when underwriting an account.

Efficiency and sponsor bank redundancy

Multiple sponsor bank relationships

We love our partner banks, but there’s no such thing as a perfect bank for every use case. We’ve expanded our ability to serve more use cases by adding additional banks to sponsor payment rails.

World-class sponsor bank reporting

The payments and financial service industry has been reeling from multiple bank closures and OCC consent orders last year. Moov takes our role as an agent of our financial institutions seriously and has pioneered completely transparent reporting to our sponsor banks, ensuring proper oversight and compliance.

Continuous transaction monitoring

As volume on our platform has grown, we’ve deployed new and better ways of monitoring transactions for suspicious activity and creating automated workflows to investigate anomalies.

Looking ahead

2024 was a transformative year for Moov, and it still feels like we’re just getting started. Each of these projects reflects our commitment to delivering seamless, innovative financial tools for businesses and developers.

2025 will be our biggest year yet. Our focus is fixed on simplifying money movement and delivering unmatched user experiences. To everyone who has joined us on this journey—thank you for your support, feedback, and trust.

Here’s to another year of innovation and growth!