The beginner's introduction to card issuing

From a consumer’s perspective, debit and credit cards are relatively straightforward. You sign up for a card, and you use that card to pay for goods or services – either with money directly from your account (for debit card purchases) or with borrowed money that you’ll pay back (for credit card purchases).

However, if you’re exploring innovation in fintech or just trying to understand how cards work at a deeper level, you’ll find that cards encompass a whole world of terminology, key players, and regulatory standards. In this post, we’ll specifically tackle the topic of card issuing. Stay tuned for future posts related to cards – card acquiring, ISO8583, and other topics covered by our in-house experts.

How issuing fits into the card payments ecosystem

There are two major “sides” to card-based transactions: acquiring and issuing. Acquiring allows merchants to accept card based transactions. On the other side, issuing focuses on developing a card program, distributing cards, and approving/denying purchase requests. Both acquiring and issuing are heavily regulated spaces, since the government, card brands, and issuing banks all have a vested interest in making sure there’s no accidental or malicious financing of criminal activity in the cards space.

In order to be in the card issuing space, you need:

- An issuing bank

- A program manager

- A connection to the card network

Sponsorship and compliance: the issuing bank

In order to run a card program, you need a relationship with an issuing bank. In the US, government regulations mandate that financial products and services can only be provided by certain entities, and only banks can be members of the card associations. Any card being issued is, in a sense, sponsored by a bank – even if your favorite grocery store or airline brands the card, there is an issuing bank responsible for that card.

Implementation: the program manager

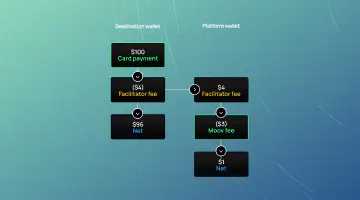

For every issuing card program, there must be a designated program manager. The program manager is the entity responsible to the bank for ensuring all the bank’s risk and compliance requirements, network rules, and other standards are upheld for a particular card program. Because this is such a high-touch process, the program manager earns interchange fees associated with card transactions.

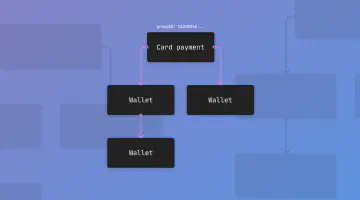

Connecting to the network: the issuer processor

The issuer processor is responsible for moving data and following the network rules to ensure that money and transaction data gets from point A to point B. When someone’s card information is entered at the point of sale, the acquiring processor creates a payment authorization request, which gets sent to the issuer processor. The issuer processor then evaluates that request, approving or denying it based on the rules of the network and the issuing card program. The issuing processor is also responsible for settlement - ensuring funds are moved to the acquiring side after purchases are made.

Card issuing use cases

In general, cards allow companies the opportunity to build customer loyalty and monetize payments through interchange fees. However, as creative business ideas continue to proliferate, the use cases for card issuing have gone beyond your traditional cash back or points-based rewards programs. For some more concrete examples, we’ll highlight a few creative card issuing use cases.

Treecard

Treecard works with Sutton Bank to issue a unique Mastercard debit card, leveraging a cut of interchange fees to fund reforestation and climate investment. This is a creative application of fintech expertise for a socially responsible cause. Depending on the success of Treecard and other cause-based cards, we could see more social-good focused finance enterprises enter the market.

Ramp

Ramp provides financial solutions for businesses ranging from accounting to expense management. One of their solutions is a virtual corporate card. Virtual cards are the same as physical cards in that they must be issued by a bank and have their unique numbers – the only difference is that they don’t take the form of physical plastic.

One of the key advantages of issuing virtual cards for corporate spending is the added security factor. Because these cards are virtual, they can’t be stolen or lost. You can customize a virtual card with spending controls, and if any issues arise you can immediately cancel the card. There are applications for virtual cards beyond just what Ramp has demonstrated, including the gig working economy, cards for kids and teens, and subscription spending management.

Cash card

The peer-to-peer payment app, Cash app, also issues a card which can hold stored value that a user accumulates from peer-to-peer payments. Rather than cashing those funds out to a bank account, they can simply use their card to make purchases anywhere at merchants’ retail locations and online. Venmo and PayPal have followed suit with similar products for their users, while Square also offers a business debit card equivalent. Re-envisioning the more typical debit card experience, by developing partnerships with different merchants, fintechs have the opportunity to monetize payments and build consumer brand loyalty through a new avenue.

There are a plethora of other card issuing use cases we haven’t highlighted, including the more classic points and rewards-based credit cards, HSA and FSA cards, commuter cards, or even certain types of gift cards. The current fintech landscape is continuing to make the world of card issuing interesting and ripe for further innovation.

Getting started in the world of card issuing

This is by no means a comprehensive guide covering all it takes to launch a card program. However, if you’re interested in issuing cards of your own, it’s a good idea to start by thoroughly planning out the business goals of your card product, including your target market, the value you want to provide by issuing these cards, as well as how you’d like to structure fees.

Because developing a card solution can become a deeply complex effort, it’s crucial to identify the right fit when it comes to who you’ll be working with for bank sponsorship and issuer processing. There are certain tradeoffs that you’ll need to consider at the outset; for example, program management is one of the most cumbersome and crucial aspects of card issuing. If you choose to absorb the responsibility of program management in-house, you can also retain a higher cut of the interchange revenue. However, if your company doesn’t have the capacity to absorb that responsibility, then looking for a trusted fintech provider that also serves as a program manager will be a priority. The speed at which you’re trying to launch your card and how configurable you want your program to be will also be key factors in determining who you’ll want to work with.

In closing

Throughout recent years, the rise in fintech has contributed to more pathways to card issuing. Many companies have emerged with card issuing solutions focused on greater speed, simplicity, and configurability to varying degrees. However, at the end of the day, the bread and butter of card issuing will always still be: bank sponsorship, program management, and processing technology.

Moov doesn’t yet issue cards, but we are constantly growing the number of ways to accept, store, and disburse money, so stay tuned for updates as we continue to add new payment rails and product features. If you’re interested in product updates, keep following our blog for updates or join our monthly newsletter. And, if you want to hear more from us on the world of cards, feel free to reach out to us with your suggestions, questions, or comments.