The beginner's guide to real-time payments

Real-time payments (RTP) is a payments network owned by The Clearing House (TCH). RTP enables 24/7 real-time electronic payments in the US, meaning you can transfer and receive funds immediately over its network at any time.

Operationally, RTP differs significantly from the Automated Clearing House (ACH) network, which is processed in batches and can take several business days to settle. Unlike ACH, which supports “push” and “pull” transactions, RTP only supports push transactions. You cannot debit or pull from another person’s account via RTP. There is an option to send a “request for payment,” but it is up to the payer to initiate a push payment to the requestor.

How money moves with RTP

The parties involved:

- RTP network

- Payer

- Payer’s financial institution

- Payee

- Payee’s financial institution

To enable real-time payments, you must either be a participating financial institution or an authorized third-party service provider (TPSP) on the RTP network. RTP operates on a liquidity model where participating financial institutions need to keep a minimum pre-funded account balance with the Federal Reserve as a way of guaranteeing immediate funds transfer.

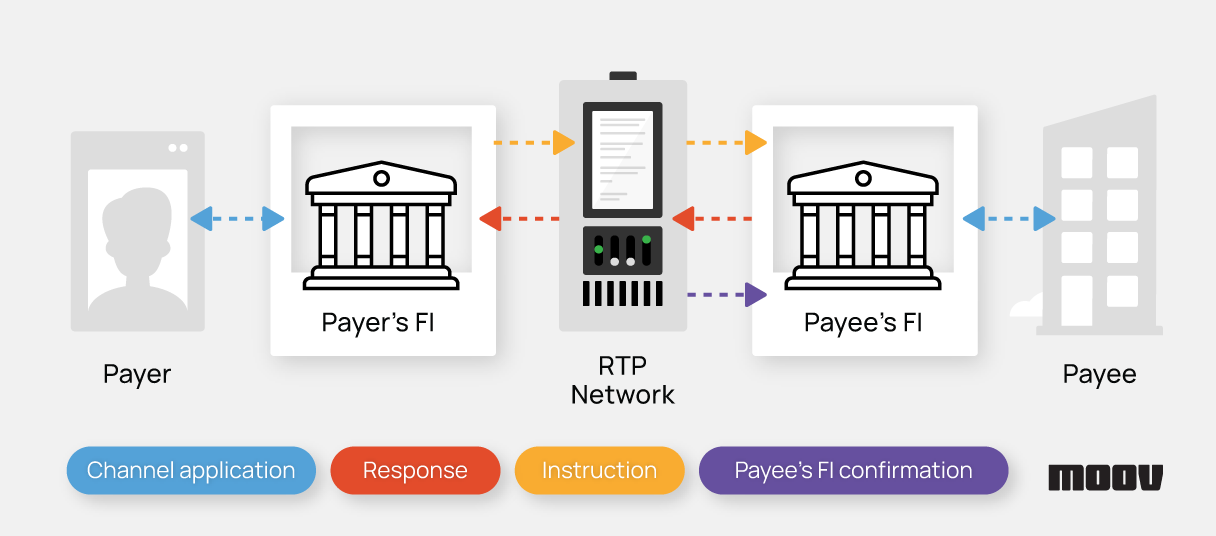

The payer will initiate payment through a “channel application,” which is either the bank or the third-party service provider’s (TPSP) interface. The payee doesn’t need to do anything—as long as their financial institution is participating in the RTP network and the transfer succeeds, funds land in their account immediately.

When the payer initiates the RTP payment through a channel application, they generate a “payment instruction” to their own financial institution. The transaction then occurs through messages between the sending/receiving financial institutions and the RTP network.

For any transaction, the RTP network will:

- Validate each message

- Check the liquidity of the sender’s financial institution

- Send the payment or note payment failure

All messages over the RTP network are formatted according to ISO20022, which is a global standard for all data elements involved in payments. When an RTP payment gets sent, a series of messages get sent between financial institutions and the RTP network:

- Sender’s financial institution (FI) will send a message through the RTP network to the recipient’s FI

- The recipient’s FI will send a response message through the RTP network to the sender’s FI

- The RTP network will send a confirmation to the recipient’s FI

Funds settlement happens immediately. Once a transaction has gone through, the RTP network will immediately decrease the balance (otherwise known as the “current prefunded position”) of the payer’s FI, and concurrently increase the balance of the payee’s FI.

Setting up RTP payments

While the RTP payment flow is relatively simple, RTP payment integration requires the appropriate institutional backing and understanding around ISO20022 messaging protocols.

As we continue to build Moov, we’re developing a simplified way to integrate this payment rail (along with others like ACH and cards) without having to build the prerequisite infrastructure from the ground up.

Subscribe to our newsletter to see what we’re building next or join our public Slack group to chat directly with developers, builders, thinkers, and doers in the financial technology space.