How Moov is changing lender-to-contractor disbursements

Moov is saving a lender a million dollars a year, but they’re thanking us for something else.

Before I tell you what that is, let me share a little story.

Two months after buying my first house, the furnace went out. This was in the dead of winter, in Chicago, on New Year’s Eve. Two things became immediately evident. First and most obvious, you can’t handle winter in Chicago without a furnace. Second, and almost as obvious, an emergency furnace installation on New Year’s Eve is expensive and the contractors willing to make it happen need to be paid whether it’s New Year’s Eve or not.

I couldn’t avoid paying my HVAC contractor by explaining the complexities and shortcomings of current payments infrastructure. People work hard and deserve to be paid when they need it. Luckily, I was able to pay the contractor, but this isn’t always the case. Sometimes payments, even from trusted lenders, get hung up. There need to be better ways to ensure contractors get paid when they need it, so that they can get to work right away—and so homeowners like me don’t freeze.

This is why I’m writing this—to shine a light on how Moov and our lender partners are enabling faster, more flexible, and more cost effective payments to contractors.

Why speed matters in lending

The lender I mentioned above is a nationwide lending platform for the construction industry. They disburse funds to contractors roughly 10,000 times a month and, until those contractors receive their money, jobs don’t start, materials aren’t purchased, and subcontractors don’t get paid. The speed and timing of those disbursements is crucial.

In the lender’s words, “Literal money movement is as impactful and tangible as our decision to lend money in the first place.” Because, to them, lending isn’t just a question of why do they need the money, it’s a question of what happens if they don’t get it?

This lender finances critical on-the-spot, in-the-moment jobs. Without speedy disbursement, contractors might not be able to start a time-sensitive job for a homeowner in need. Anyone who’s ever worked with a contractor knows that not all delays are equal. A one-day delay may eat up an open window in a work schedule, which can delay the job for an extended period—or force the homeowner to search for another contractor.

How Moov solves for speed in lending

To avoid this kind of delay, most lenders send money the fastest way they can, via a wire transfer.

Problem solved, right?

Try telling that to the contractor who’s both angry and still short on funds because of the wire fees they’re being charged to accept the payment.

Lenders can eat those costs, but the median charge for a domestic wire is $15, and those add up quickly when you’re sending a lot of wires. Also, unfortunately, [insert your favorite payment gateway here] doesn’t handle wire transfers. Sending wires is a unique banking process that’s disconnected from all other ways money is sent or received. So, on top of being expensive, wires can be pretty problematic.

Back to my dead furnace example.

Wire transfers don’t happen on weekends or holidays either. If we’d been tethered to traditional lender disbursements on that frigid New Year’s Eve, my contractor wouldn’t have been able to start working on the holiday and I wouldn’t have gotten a new furnace for at least two days. Speed to funding doesn’t mean much if it’s not 24/7.

Contractors don’t get to stop working during evenings, weekends, or holidays. They shouldn’t suffer for that, floating expenses or going without payment because their lender can’t deliver. And if Zelle can disburse payments 24/7/365, why can’t lenders?

Truth is, our current payments infrastructure just wasn’t made for modern lenders. Most payment rails were built when the internet was barely a thing. How could they meet the needs of a nationwide, cloud-based, instant-decisioning business lender?

All of this is what the lender I mentioned above was dealing with.

But now, with Moov’s infrastructure, they can offer a range of payment options like ACH and Same Day ACH or instant transfer options like RTP or push-to-debit. They can let their contractors choose how they want to get paid on a transaction-by-transaction basis—and therefore, what associated cost to pay—based on the real-world impact of that particular situation.

But again, while this lender loved their million-dollar savings, something else far outweighed this benefit.

Why flexibility matters in lending

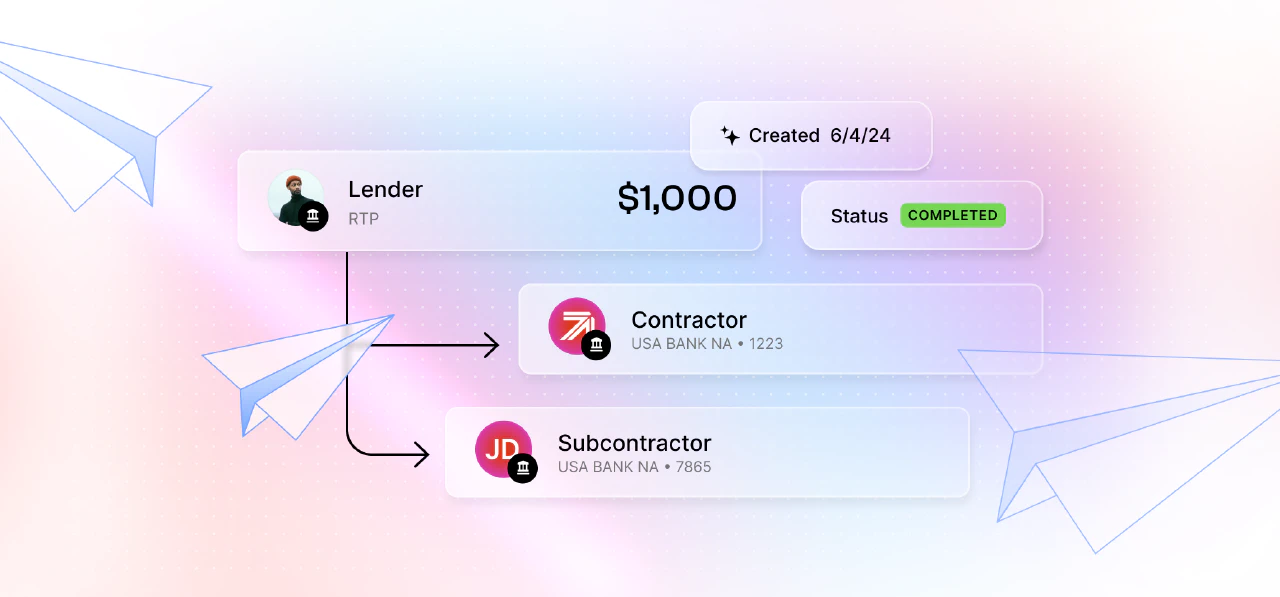

Business lending is an ecosystem. Our construction-focused partner doesn’t give contractors money to sit on; they fund construction jobs in real time, which means the money needs to move downstream to subcontractors fast. But if contractors can’t immediately and accurately move and track funds downstream, jobs can still get delayed.

The ability to move funds to multiple recipients as part of the original disbursement could solve this, but traditionally lenders can’t directly pay those downstream parties. They have no control or visibility once the funds are disbursed to the contractor.

Our lender partner wanted to change this, and Moov’s ledger-backed wallets allowed them to do just that.

How Moov solves for flexibility in lending

At their most basic, Moov wallets are financial accounts with real-time ledgering capability that can be linked to other bank accounts or payment cards. We handle all the necessary background checks and due diligence required to hold or move money in the account holder’s name.

By disbursing funds to their contractors’ Moov wallets, lenders can fulfill the legal obligation to fund the contractor, while maintaining the ability to initiate additional, secondary transfers from the wallet to other parties. And all of this is ledgered in real-time within our platform. Legacy systems can’t do this but, with our help, our partner is bringing all new capabilities into the lending market.

And they aren’t done yet. Moov allows them to release, direct, and track loan spend in a completely new, automated and frictionless way. This enables a lot of new use cases and, as they plan future initiatives, our lender partner is looking to develop more unique capabilities, such as:

- Using Moov wallets for servicing escrow or multi-stage disbursements, where money is released when specific milestones are reached.

- Offering prepaid cards that contractors or subcontractors can use to access wallet accounts.

All of this and more is possible because Moov isn’t just another gateway on top of pre-internet infrastructure. It’s not, as our CEO likes to say, just lipstick on a pig. We’re an all-new kind of infrastructure—direct, flexible, and capable of enabling immediate and multi-party disbursements.

This is why we’re seeing a surge in lenders seeking our services: We have the flexibility to accommodate their everyday and urgent use cases.

What they’re really thankful for

We love working with lenders. Enabling that savings feels great to all of us here at Moov. We’re beyond excited to see this lender continue growing and thriving. But what did they say they’re really grateful for? What’s the number one reason they’re happy to work with us?

They love having the ability to evolve.

They’re changing the model of what lenders can accomplish. They’re grateful to Moov for opening up entirely new business opportunities, for making them more than just another lender, and for helping them build a future they never would’ve imagined.

If your lending business is looking for new ways to evolve and serve your borrowers, let’s connect. Reach out today to learn if saving a million dollars is just the beginning for you, too.